The biggest yield farming winners are still the ETH miners since ETH mining is much more profitable than BTC but this will not be for long as we are reading more in the Ethereum news today.

At the start of the year, Bitcoin mining was more profitable than Ethereum mining but this changed once Compound announced COMP liquidity mining and started a mini bull run for DeFi on ETH. ETH miners are the biggest yield farming winners from a risk-adjusted basis and with the layer two solutions now imminent, the mining boom is expected to come to a mid-term stop.

Ethereum miners are making huge profits and some have even surpassed the earnings of lucrative BTC miners. As the network moves towards the layer two solutions, ETH miners will have a hard time sustaining their high earnings. Bitcoin is still the most capitalized cryptocurrency which makes the BTC mining industry larger than the one of other cryptocurrencies. Over the past few months, Ethereum has outpaced Bitcoin and became the most profitable cryptocurrency to mine.

At the start of the year, Bitcoin miners earned between $100,000 and $360,000 a day in fees as well as more than a million dollars in block subsidies. ETH miners were making between $40,000 and $150,000. In July the situation changed as Miners were raking more than $600,000 in fees with block rewards growing more valuable with the price appreciation at the end of the month. In the meantime, block reward halving reduced the main source of revenue for miners as the daily average fee income for miners was $810,000 in July. For ETH miners, this figure was 35% higher.

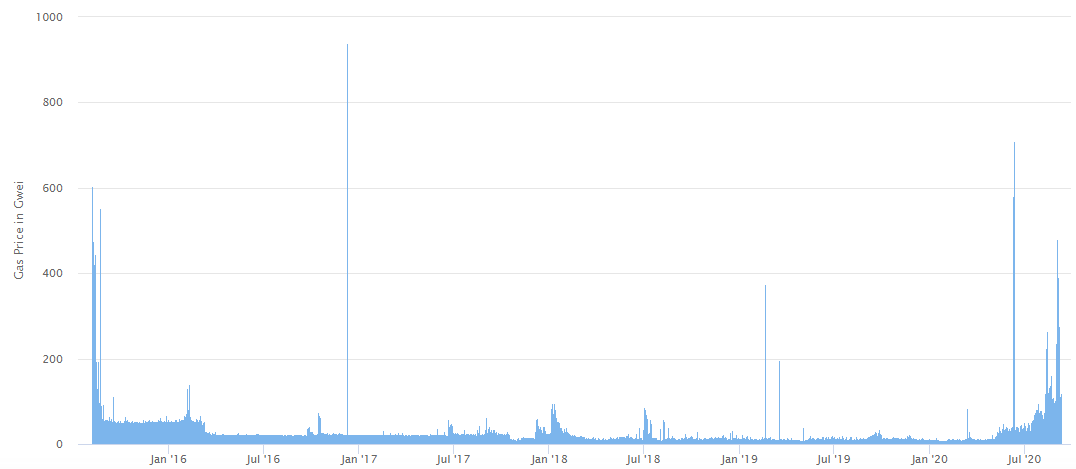

The catalyst for the explosion in ETH usage can be traced back to the start of the Compound’s liquidity mining. Although liquidity mining and yield farming existed a while ago, Compound’s launch marked the start of the Defi bubble. DeFi then became the center of attention for the rest of the crypto market. The boom came at a cost as ETH miners were thriving financially at someone else’s cost. The users were paying up to $100 to confirm a transaction on ETH as many people were priced and the rest paid high fees because the profit for doing that was higher. The average gas cost was eight gwei in April and June and more than 120 in August.

Layer two solutions that reduce dependency on the blockchain are coming to completion and this upgrade will reduce the costs of using DeFi.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post