About 70% of ETH addresses are in high profits right now, setting a two year high as Ethereum skyrockets in value, as we are reading today in our Ethereum latest news.

ETH’s surge to more than $300 created the most profits for about 70% of ETH addresses in over two years if we take into consideration the on-chain data. Glassnode analysis said that today’s 71% of tracked ETH wallets are “in profit” which breaks the previous high of 68.17% seen one day ago. Some positive factors supporting the price surge include the overall favorable view of Ethereum’s technology and the latest Visa Announcement of building new applications on Ethereum while at the same time bitcoin was ruled “money” from a US-based court.

📈 #Ethereum $ETH Percent Addresses in Profit (1d MA) just reached a 2-year high of 71.727%

Previous 2-year high of 71.616% was observed earlier today

View metric:https://t.co/caVzUVoOt2 pic.twitter.com/4HqpR1HXk5

— glassnode alerts (@glassnodealerts) July 27, 2020

Institutions are accumulating as Fidelity Investments survey the year and concluded 11 percent of all surveyed American and British money managers are holding ETH. Industry observers say that DeFi contributes to most of the bullishness in Ethereum and it’s just a matter of time before the network over which the Defi projects are built on finally catch on with the true value. It’s even caused some of the most prominent Bitcoin holders to accumulate ETH as Raoul Pal for example who is an Ex-Goldman Sachs alumni and the founder of Real Vision:

“I am getting increasingly bullish on Ethereum. ETH is the silver to Bitcoin’s gold. It has more industry uses and less store of value uses (…) ETH is all about adoption rates and usage. Basically, it’s all down to something called DeFi.”

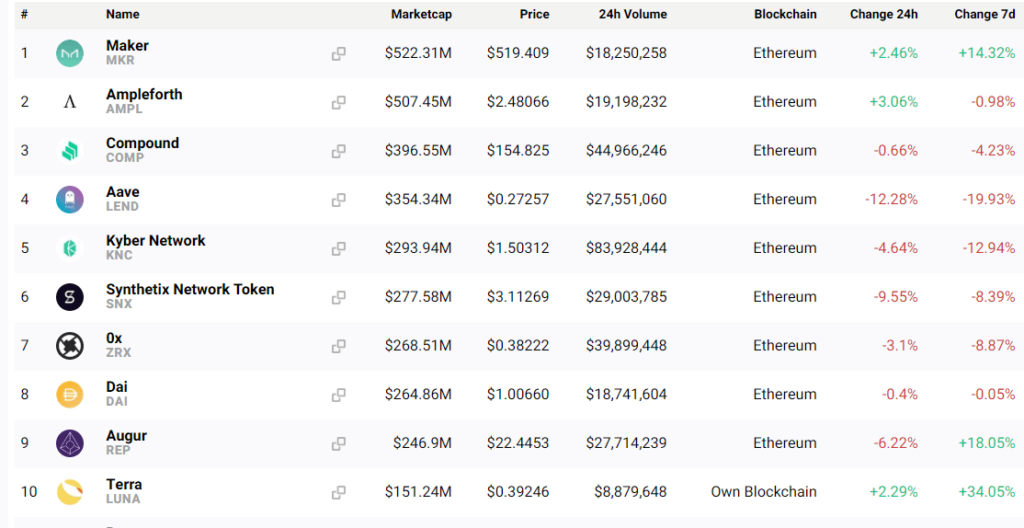

The DeFi tracker shows nine out of ten projects that operate on Ethereum which creates a strong fundamental for the network considering billions are now locked in the blockchain. Despite the rise in projects such as Aave, Band, and YFI, the overall DeFi sector slightly dipped in the previous week as investors lost about 11 percent. Some such as FinNexus gave more than 50 percent returns while Aave lost 16 percent.

The mainstream media is starting to take attention and it reported on the DeFi effects for millions of traders with a strong twist towards Yield Farming. The media also explored multiple DeFi projects and the APY’s on some of them including the risks involved. Ethereum trades at $309 at the time of writing.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post