Pro traders turn bullish on the EOS price according to the derivatives data that we have in our latest EOS news today.

The retail traders turned their backs on EOS but the pro traders turn bullish on the cryptocurrency. EOS rallied in May after Block.one which is a blockchain software company announced a $10 billion funding round to build an EOS-based exchange platform called Bullish. The EOSIO development company revealed that it raised capital from Mike Novogratz and Peter Thiel as well as hedge fund managers Louis Bacon and Alan Howard.

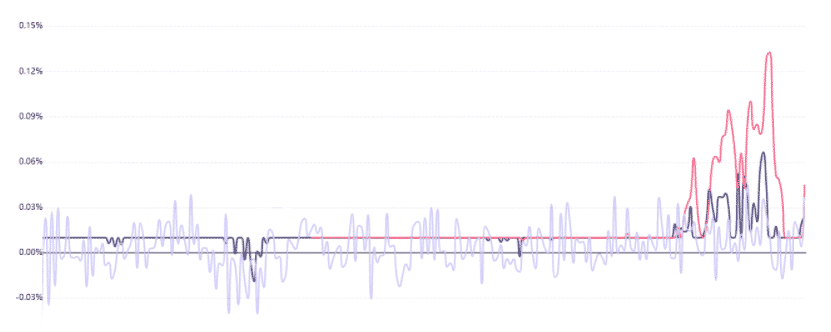

With the bullish news, the recent $6 top stands 60% below the $15 high reached on May 12 which leaves investors with no reason to celebrate. At the moment, the retail traders are not comfortable using leverage for the bullish positions and the professional traders were neutral but became optimistic since mid-July. Analysts pointed to a new report by Block.one which suggests an increase in inflation rates from 1% to between 1.2% and 3.8%. The new issuance rate will be needed to increase the financial incentives for the voters and block producers. However, the lack of deliveries and partnerships caused EOS to lose steam and the price dropped to a low of $3.04. the bearish trend ended in June as the little-known exchange said it will be going public on the New York Stock Exchange.

The positive and lasting trend initiated as the exchange released its private alpha version and promised a full launch later in 2021. The project mentioned that it will not have spot trading, liquidity pools, and margin trading. EOS later announced more access to live pricing data using real-time market information by AlgoTrader. The startup oracle includes multiple assets from various exchanges and can create derivatives, stablecoins, and synthetic instruments. To understand whether the traders are leaning bullish on the EOS price and its $5 zone, one should analyze the contracts futures data which is the retail traders’ preferred instrument for leverage because the price tracks the regular spot markets. There’s also no need to manually roll over the contracts that are about to expire.

In the futures contract, trade longs and shorts are matched at all times but the leverage varies. Exchanges will change which side uses more leverage at a funding rate to balance their risk and this fee is paid to the opposing side. It is also useful to analyze the quarterly futures contracts as the whale’s trade these instruments frequently. In the next month, the eventual demand imbalances are reflected by a price difference versus the regular spot markets.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post