ETH plunged under $600 as the rest of the market entered the red zone as a result of the strong selling pressure on the market. It started with XRP which also started to drag the market lower due to the results of the latest US SEC lawsuit against Ripple. In today’s Ethereum price news, we take a closer look at the price analysis.

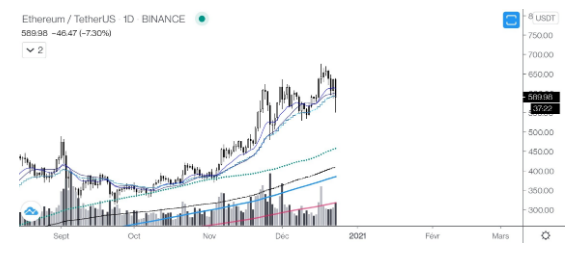

ETH now trades at $590 but traded as low as $550 in just 30 minutes on leading centralized exchanges. The market moves strongly with the cryptocurrency not being able to reach the level on decentralized exchanges. Most of the traders are not sure what exactly will happen to Ethereum and the rest of the crypto market there while some analysts say that the coin has to close above $600 to ensure that the bullish position is maintained. The charts show that in the wake of the dump, ETH plunged under $600 and broke key technical support levels that held for most of the price rally in the past three months.

As recently reported, Ethereum bulls launched a strong recovery after the coin saw a strong selloff overnight that led the price to new lows of $585. This is around the same price level where the cryptocurrency was able to find some support that eventually ended up looking as a V-shaped recovery.

Where will it trend in the mid-term depends on the follow-through of this recovery as the strong rebound from here being able to confirm that these lows will mark a long-term bottom. Rejections at $620 which was a resistance level over the past few days, could temper the technical strength and one analyst also noted that the overnight decline puts the crypto in a precarious position with ETH invalidating the bull trend.

The market move resulted in a lot of smaller-cap altcoins fall against the dollar by around double the amount that BTC did. Even decentralized finance coins that were quite resilient saw a strong move to the downside. Against all odds, the Synthetix Network Token gained 30 percent in the past 24hours alone. SNX is the top-performing crypto in the top 100 by market capitalization that outpaced Bitcoin’s increase. The SNX volume shot through the roof over the past few days as Synthetix surged 30% and investors started waking up to the crypto potential. SNX was a coin that underperformed in the Defi space. “Smart Money” addresses as defined by Nansen, was accumulating the coin over the past week.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post