The DOGE risk grows bigger for Robinhood’s crypto business operations as the coin makes up the bulk of the company’s revenue and Robinhood admitting that the asset’s unpredictability is a huge issue for future operations so let’s read more in our Dogecoin news today.

Robinhood listed Dogecoin as a risk for the company in its Q2 earnings report.

buy vibramycin online www.parkviewortho.com/wp-content/languages/new/prescription/vibramycin.html no prescription

Dogecoin alone made up 62% of the crypto revenue for the span. As the DOGE risk grows bigger for Robinhood, it became one of the most volatile cryptocurrencies ont eh market with price swings moving in both directions, influenced by social media sentiment. It has been a huge boon for the crypto and stock trading app so far but the company still thinks it presents a huge risk for business.

In the Q2 earnings report, the first since the company went public, Robinhood said that the crypto accounted for 41% of its overall revenue for the span and 62% of that figure came solely from Dogecoin even though Robinhood lets users buy and sell coins like ETH and BTC. This is a huge chunk of revenue from a meme coin while the entire crypto busienss sector is growing. Although DOGE is now responsible for the huge amount of incoming revenue for Robinhood, the company recognized that its volatile nature means no such inflows could be unreliable in the future as per the report:

“A substantial portion of the recent growth in our net revenues earned from cryptocurrency transactions is attributable to transactions in Dogecoin. If demand for transactions in Dogecoin declines and is not replaced by new demand for other cryptocurrencies available for trading on our platform, our business, financial condition and results of operations could be adversely affected.”

The Q1 report shows a similar story as the company called out Dogecoin as a risk factor regarding its crypto business. Back then, cryptocurrency accounted for 17% of the company’s overall revenue and DOGE’s share of that revenue was 34%. now that the share is double that, the risk is even bigger. Robinhood’s report shows that Dogecoin has a changing momentum that can affect its future business if the price drops or it becomes more available to purchase on competing platforms and exchanges.

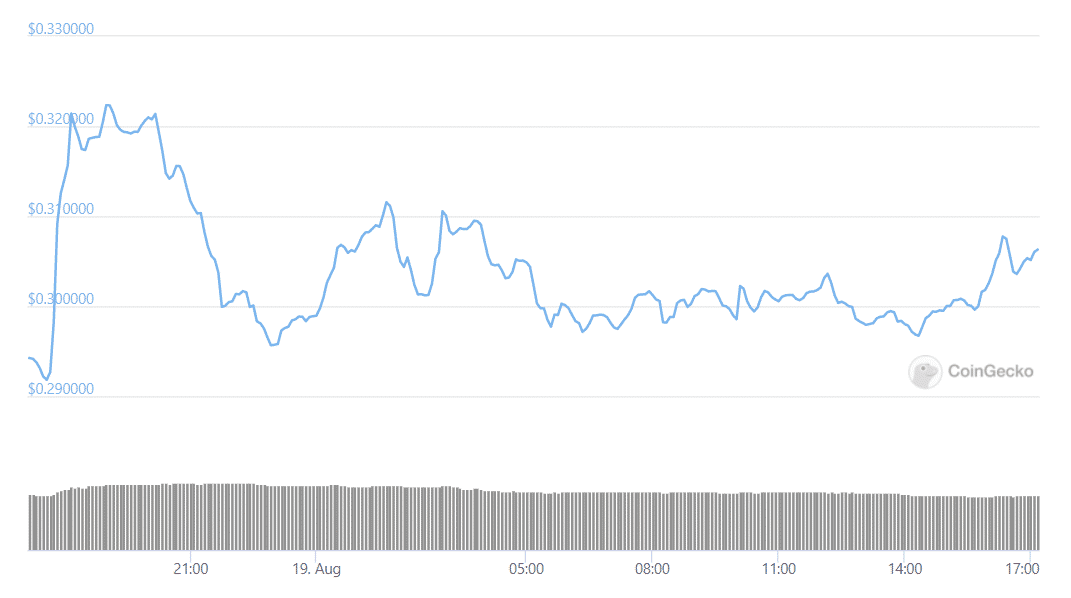

Robinhood is one of the leading marketplaces for Doge so far. Even at a current price below $0.30, DOGE delivered huge returns to holders that got here before the surge.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post