Cosmos welcomes DeFi into the network thanks to the Gravity Decentralized Exchange as we can see more in our latest Cosmos news today.

We just started the second quarter of 2021 and we already saw a record-breaking year for Cosmos. Its expanding network of blockchains built with the environmentally friendly Proof of Stake Cosmos SDK technology comprises more than 240 apps and services that have about $100 billion of assets under management.

Cosmos includes powerhouses like Terra, Crypto.com, Binance Coin, Cosmos Hub, and others. It’s an ecosystem that looks set to expand thanks to the stargate upgrade which helps developers built energy-efficient blockchains with the highly anticipated Inter-blockchain Communication protocol. The next step for Cosmos is its quest for a multichain future and bringing Defi to Cosmos by using Gravity as an inevitable force. With the combination of the most advanced Interchain DEX, Gravity is built by Tendermint and the B-Harvest Team as well as a secure decentralized bridge to Ethereum by Althea Network.

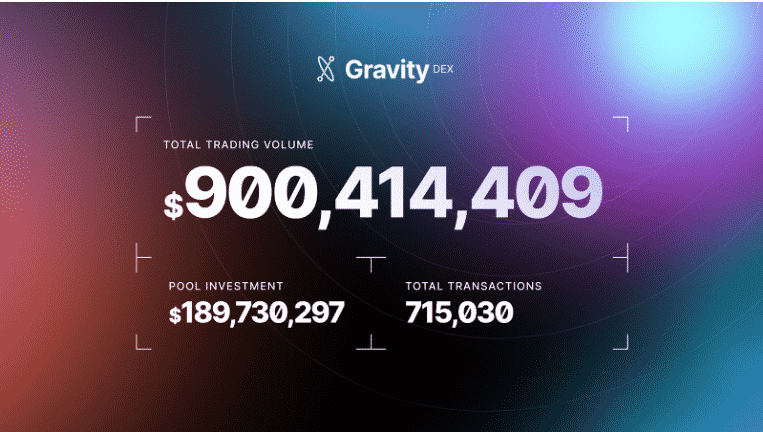

Cosmos welcomes Defi with a successful incentivized testnet that saw 20,000 traders racking up a total swap volume of $900 million over more than 715,030 transactions. Gravity DX already moved much closer to the mainnet. Using IBC to enable swaps and pools of assets between blockchains in the Cosmos network and further, the utility of the Hub and its native ATOM token is vastly increased, and even before the connections outside of the Cosmos are switched on, there’s 20 times more liquidity flowing through the Hub.

With the user-friendly interface, Gravity DEX has a few advantages over the existing Ethereum-based DEXs. These include improved price consistency which eliminates the slippage and improved order execution via batch execution, removing the potential for front-running. It is coming with order book capability which allows traders to get a better picture of the future price action. Gravity will allow users to access the IBC enabled tokens in Cosmos as many of them are already hard to buy and are not listed on centralized exchanges. Tendermint CEO Peng Zhong said:

“A DEX that’s powered and secured by the ATOM is going to encourage new chains to start trading and create liquidity, more traders to start arbitraging, and developers to see that they have a new path to start listing their tokens permissionlessly and getting people to invest… That’s really huge.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post