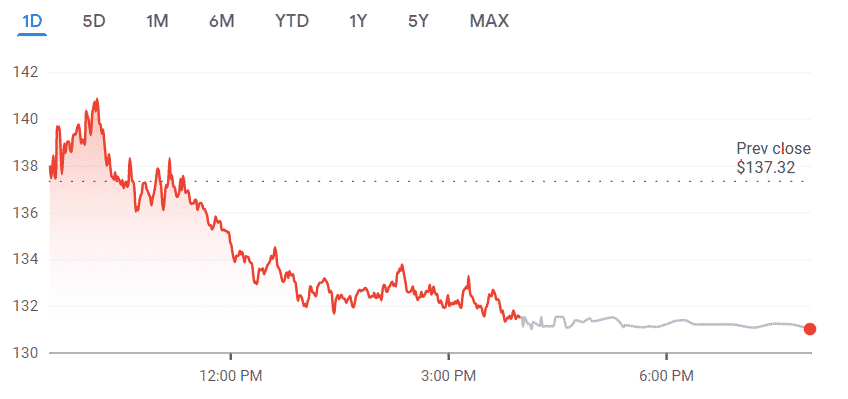

The Coinbase stocks reach a new low after the NFT market rollout and the shares got down by more than 15% and the stocks dropped by 47% so let’s read more today in our latest Coinbase news.

The Coinbase stocks reach new low two days after the crypto exchange launched its NFT marketplace with the shares on NASDAQ dropping to $131 in after-hours trading which is down by more than 15% since the marketplace beta launch. The launch was hyped for over a year and failed to reverse Coinbase’s month-long stock crash but since January, the stock shed 47% despite the difficult year, the trading dwarfs 16.39% YTD losses for BTC and 21% for ETH.

JPMorgan analyst Kenneth Worthington cut the price target for coin by31% to $258 and explained the call in a note to clients and wrote:

“The crypto markets are in need of some excitement in terms of new products and/or new use cases to continue to drive the crypto markets to becoming more mainstream, thus driving activity levels.”

It seems that the Coinbase NFt marketplace for now failed to generate much excitement btu the paltform did join a crowded ecosystem including Rarible, OpenSea, Foundation, SuperRAre, Nifty Gateway, and LooksRare. Coinbase’s marketplace is different from the competitors by outlining the communal experience and encouraging the NFT artists and buyers to interact and to connect with social features similar to Instagram.

The platform aggregates any NFTs for sale on the ETH blockchain across markets and it is still limited access and open to the millions of users waitlist. It doesn’t support platform NFT minting or other blockchain platforms but plans to add more at an unspecified date. The launch was initially planned for late 2021 but it comes at a time were the NFT market seems to be cooling down. Despite the coinbase entry to NFTs, the exchange’s bet on community engagement came at a time when the NFTs grew in utility.

As recently reported, The leading US-based crypto exchange Coinbase plans to acquire Turkish crypto exchange BTCTurk for $3.2 billion. Coinbase could acquire the exchange soon and sources familiar with the matter disclosed that the US company will employ its shares and cash to complete the purchase. According to reports, the initial price of the deal was $5 billion but due to the depreciation of the Turkish Lira and the BTC drop, the parties shook hands on the $3.2 billion agreement.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post