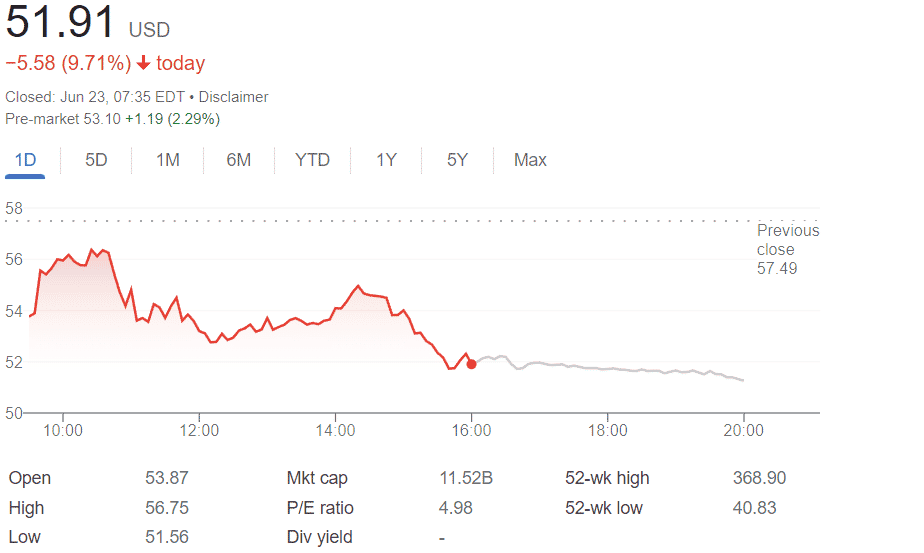

Coinbase shares drop alongside the cryptocurrency prices which hurt almost all related equities as well so let’s read more today in our latest Coinbase news.

The Coinbase shares drop by 7% back on Wednesday and lagging crypto peers as the BTC and ETH prices both dropped by 6-8% after binance.US said it will introduce zero-fee trading for BTC. Other crypto stocks like MicroStrategy, and Galaxy Digital held up with Galaxy adding 0.6% in Toronto and MSTR losing 1%. Cipher Mining and Hive Blockchain as well as Marathon Digital all dropped by 3% at least. The race to offer customers little or no fees on trading goes on and can add to competitive pressures for exchanges. Binance.US said that it will offer zero-fee BTC trading on the platform as it looks to add more users.

Coinbase will continue facing headwinds in the market downturn in light of Celsius and Babel Finance’s struggles according to the equity research analyst at BTIG Mark Palmer who said that coinbase is able to weather the storm given its larger size and being well-capitalized. Palmer wrote:

“While we are not at all dismissive of the impact of the current crypto market downturn, we also believe any notion that COIN would be unable to survive this latest challenge is misguided in light of the facts on the ground.”

In the meantime, Mizuho equity research analyst Dan Dolev said that he saw potential signs of the crypto fatigue in the trading patterns. Dolev added:

“COIN volumes appear to surge during sell-offs, but fail to bounce back during brief rallies. As evidence, average daily trading volume on the COIN platform on Bitcoin down-days was 15% higher than volumes on Bitcoin up-days. In recent months, however, down-day volumes are 42% higher than up-days, or nearly 3x vs. the prior ratio.”

As recently reported, The top coinbase officials sold over $1 billion worth of the stock but still maintain large positions in the exchange. The co-founder’s Brian Armstrong and Fred Ehrsam as well as chief product officer Surojit Chatterjee raked $1.2 billion in proceeds from the stock sales after going public. As per the data, this was around the same time when the San Francisco-based company’s shares saw an 80% drop. The four officials sold the shares at prices between $189 to $422 and on the first day of trading, the opening price of the shares was $381 so at the time of writing, the stock is trading at $75.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post