Coinbase goes public and as it filed an IPO form to become a public-traded firm so let’s read more in today’s Coinbase news.

The US Securities and Exchange Commission released the S-1 filing signaling that it approved the crypto trading company’s request to list the shares on the Nasdaq platform a few months after the initial filing which made it the first exclusive crypto exchange to hit this milestone. The rumors of the exchange exploring a public listing opportunity emerged in 2020 and the company confirmed the news a few months ago, revealing that it had filed an S-1 application with the SEC. The exchange announced that it was going to list a Class A share directly.

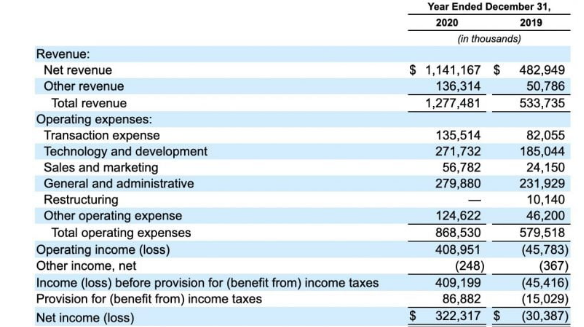

In the meantime, the publication of the S-1 filing unearthed the performance for the first time in public and showed that the exchange earned $3.4 billion in total revenue in 2020 with the transaction revenues bringing in 96 percent of the overall returns. The company showed that it earned a net income of $322.3 million in 2020 while in 2019 it suffered losses worth $30.4 million:

“We expect our operating expenses to increase significantly in the foreseeable future and may not be able to achieve profitability or achieve positive cash flow from operations on a consistent basis, which may cause our business, operating results, and financial condition to be adversely impacted.”

Coinbase didn’t share the price for the public market debut but the shares sold via the Nasdaq Private Markets were valued at $373. As Coinbase goes public, the intentions opened a portal for institutional investors go gain more exposure in the market without having to buy cryptocurrencies. Speculators will be able to purchase shares on the stock market as well and the success of their trade will depend on how the exchange does as a business. this means that growth in the crypto sector will determine the stock bias of Coinbase as CEO of BTC ATM Operator Coincloud noted:

“If [traditional investors are] more comfortable investing in stocks and putting their money behind a company with cash flow, a board of directors and the whole traditional infrastructure, they’ll appreciate the opportunity to bypass crypto volatility and invest in Coinbase stocks instead.”

Coinbase’s filing seems to come at a time when corporate and traditional investment vehicles exposed their treasuries to BTC and their moves took cues from the act as a hedge from inflation caused by the FED expansive stimulus policies.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post