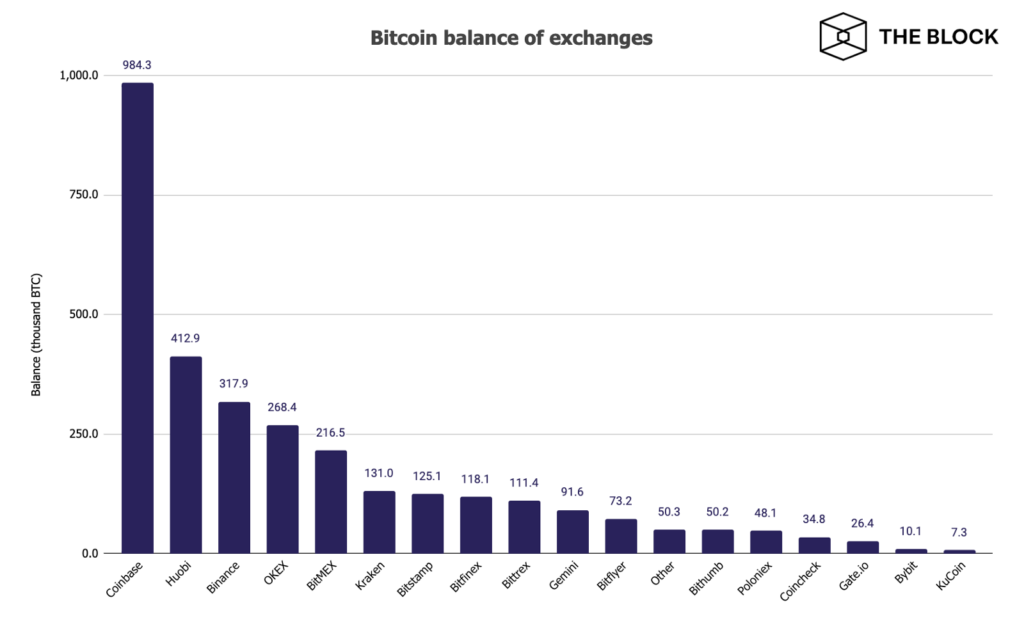

Coinbase became the largest bitcoin holder among other crypto exchanges followed by Binance and Huobi, as we are reading in the report of our Coinbase latest news today.

The crypto exchange holds about 3.

buy kamagra soft generic buy kamagra soft online no prescription

08 million bitcoin on their customers’ behalf with 16% of the total supply of 21 billion according to research conducted by TheBlock’s Lerry Cermak. While this amount looks huge, the percentage is down by 10 percent since the end of February when the exchanges held about 3.42 million Bitcoins, representing 19% of the total supply.

Coinbase became the largest bitcoin holder with 984,300 BTC in the wallets. The exchange is followed by Huobi with 413,000 BTC, Binance with 318,000 BTC, Okex with 268,000 BTC, and BitMEX with 217,000 BTC. TheBlock was gathered by multiple sources including BitUniverse, Glassnode, Peckshield, chain.info, BitFury, and BitcoinWhosWho, in order to find out the accurate amount of bitcoins held by exchanges.

Bitcoin enjoyed a slight increase in price but it is struggling to surpass the $10,000 which acted as a resistance level for the short-lived rally in May. As the momentum stalled, the investors feared a pullback. The miners who wanted the price to rise after the May 12 halving, may have to sell some more of their rewards just to stay afloat as the open interest on futures exchanges is expanding.

In the meantime, Coinbase is acquiring the startup Tagomi for between $75 million and $100 million, hoping to capitalize on technology and talent. Tagomi is valued at $72 million as the funding round caters to wealthy traders that made transactions of more than $250,000. It is also linked to a dozen of the biggest exchanges of the world including Coinbase which offers the traders the best venues for the best prices.

Also, Goldman Sachs criticized Bitcoin saying that it is not a real asset class and it is not suitable for investment. The company outlined the illegal transactions made with Bitcoin and draw connections to the Dutch tulip bubble back in the 1634s. The crypto supporters pushed back on social media so the trashing of the asset didn’t have much impact on the price. Coinbase on the other hand gladly opened its arms to Bitcoin. Another company that is more open to Bitcoin than Goldman is SIX Group with the $14 million Series A investment, hoping to connect the customers to more digital asset investment opportunities.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post