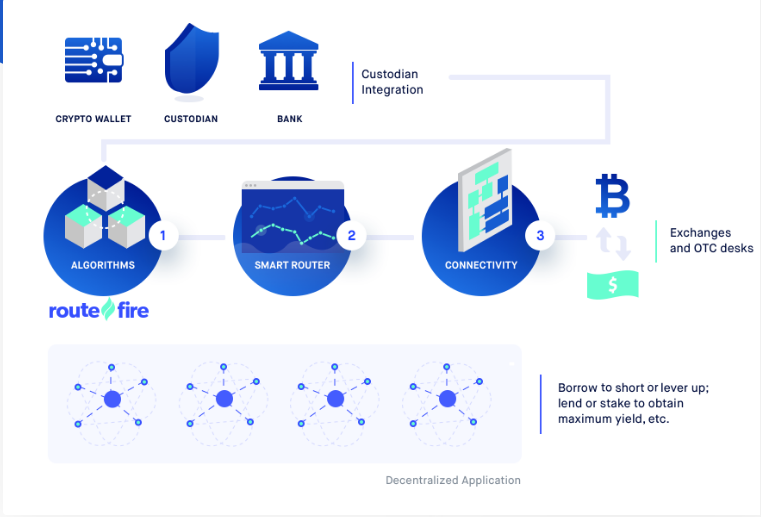

Coinbase acquired Routefire, a platform that enhances trade execution as the exchange wants to improve its Prime suite of brokerage tools, expecting a flood of institutional investors as we can read more in today’s Coinbase news.

According to a blog post, Routefire CEO Jason Victor said that the team will start developing execution services for the exchange while thanking users for their support in the past three years. Coinbase acquired Routefire which started in 2017 with one mission- to enhance the trading infrastructure in the crypto market. The developed products will allow the traders to automatically search multiple sources of liquidity and to also find the most favorable rates on the prices and fees.

After the move, Routefire’s team will start developing the Coinbase Prime suite of brokerage tools and services which are aimed to become the premier brokerage platform for financial institutions that wish to trade in the crypto space.

buy fildena online https://www.arborvita.com/wp-content/themes/twentytwentytwo/inc/patterns/new/fildena.html no prescription

Coinbase suffered a few other outages over the past year which most of the times coincided with volatile trading days for BTC, angering the traders who lost on profits. The acquisition of Routefire and its expertise will try and restore confidence in this regard. At the end of last year, Coinbase filed a registration for the initial public offering with the US Securities and Exchange Commission which was seen as a sign for improved legitimacy on the market.

As reported previously in our Coinbase news, Multiple Coinbase outages occurred a few moments after Bitcoin surpassed the $40,000 price point, doubling the previous peak that was set in 2017. A huge rejection happened moments after which resulted in a $4000 drop. However, when the investors stepped in to “buy the dip” on the Coinbase crypto exchange, they were met with disrupted services and multiple coinbase outages and stopped them from participating. Because BTC is trending on Twitter, Coinbase is as well but not for the right reasons. If the exchange wants to participate in the latest developments, it has to shape up its act before the bull run enters a new phase. On Twitter, there was a lot of outrage regarding the Coinbase outages that were experienced today during Bitcoin’s pump. BTC shot up to $40,000 from the $30,000 price point in a week and started 2021 with a bang. The move culminated today but it was rejected shortly after setting up a peak of $40,412 on Coinbase.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post