The Zeus Capital Chainlink predictions seem quite dark as they are urging investors not to get fooled and to exit their positions before it is too late as we are reading further in our Chainlink coin news.

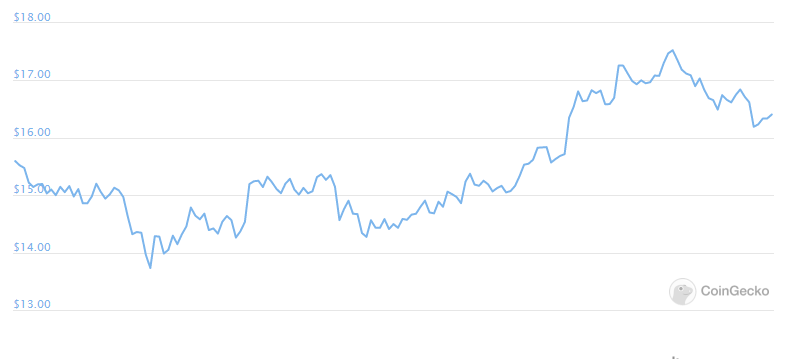

The asset management company’s involved assessment follows a huge decline in the price of Chainlink in the past few weeks as it tanked more than 20% from its all-time high of about $20 that was reached two weeks earlier. Chainlink hit a record high within weeks as the community kept on hyping the project. The cryptocurrency is up by more than 860% which landed the coin on the number five position on the list of the world’s most valuable virtual assets. The altcoin’s bull run was boosted by a campaign to liquidate Zeus Capital which had a short position on the coin as the company alleges. The reports published on the website, a Zeus Capital chainlink prediction emerged saying that the coin will crash again and that investors should exit their positions.

The report by Zeus Capital said:

“Without material technological improvements or actual user onboarding, the price almost tripled within less than a month. Lured by the rapid price appreciation, naive investors were outbidding each other.”

Zeus Capital detailed a four-part pump cycle that started at the end of July with LINK supporters on Twitter and Telegram rallying investors to purchase the coin and to liquidate the “common enemy.” In the second week in august, the supporters set a target of $11.28 to destroy the company’s short positions:

“Scared of missing out, numerous retail investors took part in the pump scheme.”

The company characterized the last phase as gloomy aftermath for all investors that had put savings and loans into the pump by using screenshots that were taken from Twitter to show the investors the losses of “savings, mortgages, and families.” The report ended by saying:

“As arrogant as it could get, the pace of Link tokens sent from Smart Contract’s development wallet to Binance intensified during the period.”

Trustnodes reported that Chainlink developers dumped more than $40 million on the token once the price hit a higher level. As LINK crashed from its ATH to $15.51 in two days, Cryptowhale characterized the token as a bubble that will soon burst and will lose 99% of the value. In the meantime, the price of LINK climbed over 11% over the past 24 hours after the news of the DECO acquisition that will improve the data transmission across the internet.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post