Blockchain analytics firm Santiment claims that LINK investors are becoming “uncertain” about the latest price surge of the asset despite the fact that Chainlink was one of the best performing crypto assets over the past few weeks as we reported in our Chainlink news.

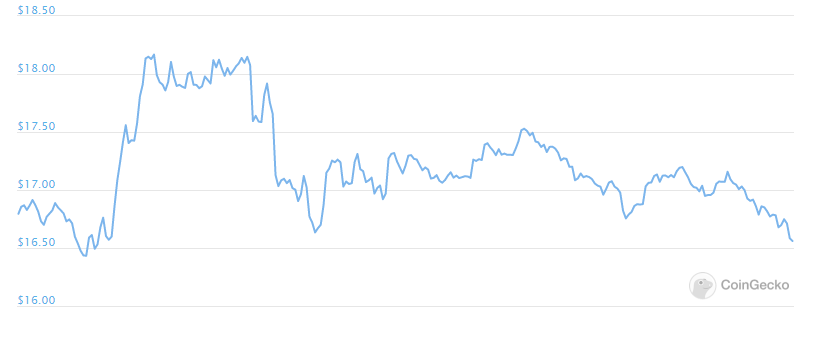

The Ethereum-based altcoin increased by 20% in the past 24-hours setting a new all-time high above $15, remaining the 5th biggest cryptocurrency after starting the year down on the leaderboard. Despite its parabolic price performance, Santiment claims that LINK investors are becoming “uncertain” about the future of the asset.

$LINK is up a whopping +68.7% in the last week. However, we are seeing signs that investors are becoming increasingly uncertain in its prolonged rally. Speculative interest has exploded, and we've looked into some concerning signs for the #1 trending coin. https://t.co/Id7GDEAw9z pic.twitter.com/fm8av3ZVUk

— Santiment (@santimentfeed) August 12, 2020

Chainlink investors are becoming uncertain about the asset’s multi-month rally. Santiment that mostly focuses on investor sentiment shared on Twitter:

“$LINK is up a whopping +68.7% in the last week. However, we are seeing signs that investors are becoming increasingly uncertain in its prolonged rally. Speculative interest has exploded, and we’ve looked into some concerning signs for the #1 trending coin.”

Backing the statement, the company mentioned three crucial metrics about LINK such as: the number of daily active deposits which has been increasing, Chainlink’s mean dollar invested age metric which started to plunge and the deposits into exchanges that hit an all-time high suggesting there are a larger number of holders that are trying to liquidate their positions.

Also expecting LINK to retrace is Zeus Capital, the alleged cryptocurrency fund that became extremely popular in the recent months for publishing a report showing that the asset could drop by 99% and according to their report:

“Based on our findings we have opened a short position in LINK and recommend you doing the same with a target price of USD 0.07 and potential upside of nearly 100%.”

The company expects Chainlink to fail because of its explosive price performance which many believed it will liquidate the partners. Zeus argued that “the end is near:”

“$LINK’s fully diluted market capitalization already exceeds the one of industry leaders like Dropbox, Western Union and Lufthansa. Users will never pay north of $12 per data retrieval. Speculative buying is a textbook example of a bubble. The end is near.”

Chainlink seems to not be even close to the end as the asset continues to push higher as the time of writing of this article.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post