New investors flood into Chainlink especially in the 2020 so this year we are bound to wait for an upside in both price and adoption. In our latest Chainlink coin news, we are looking into the analysis some more.

Over the past few weeks, LINK’s price action was kind of lackluster with the coin failing to gain more momentum as investors shifted their focus away from altcoins and to BTC. The trend shows a few signs of letting up soon as most altcoins are stagnating as BTC continues showing signs of strength. Until BTC enters a prolonged phase of consolidation or drops lower, there’s a chance that it will continue gaining more dominance on the market. Despite the short-term trend being bearish for coins such as LINK, the data shows that the cryptocurrency is much healthier than ever.

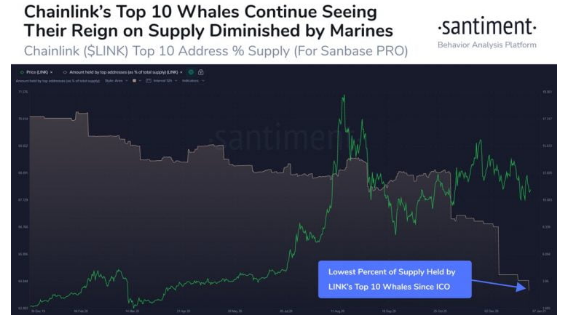

According to an analytics platform, Chainlink will be in a good position to see more upsides due to the ongoing accumulation trend among the smaller network participants. They noted that while the price underperformed BTC and other coins like ETH, the whales are holding strong with there being no whale sell-offs in signs. This could also mean that there’s a rotation of capital from BTC and towards altcoins with LINK leading the way and seeing more upsides.

Altcoins extended the consolidation trends despite the strength that was seen by BTC and ETH. Chainlink is the main example of this as the cryptocurrency was trading sideways around the current price of $11.25. This is around the same price level where it was trading over the past week. It seems that it was facing a stronger resistance in the upper $11.00 region as this is the place where it found stronger resistance which slowed down the uptrend and caused it to slide back to the $11.00 support.

Despite the lackluster price action, the new investors flood into Chainlink, and analysts are expecting to see more growth and adoption in 2021. Another analytics company noted that the number of new addresses holding and purchasing LINK spiked:

“A year ago, Chainlink’s top 10 whales held 70.7% of the total circulating supply of LINK. To close out 2020, they now hold 64.5%. This can be attributed to consistent new addresses being created on the network, & no apparent whale sell-offs in sight.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post