LINK’s price action suggests a strong retracement is underway as it contained within the descending parallel channel as we are reading in our chainlink coin news.

Chainlink managed to reclaimed the $10 mark as support over the past week but now it seems that the coin is facing a major resistance cluster which could reject it from going further. A rejection from the current price level will likely lead to a downswing movement towards $7. LINK kicked off the start of this month with a bang as the prices increased by more than 6.5% when the new monthly candlestick opened. A few technical on-chain metrics suggest that LINK is about to suffer a major correction.

After increasing to new all-time highs, Chainlink entered a major downturn which has seen the prices drop by a stunning 64%. It went from trading at a record high of $20.3 to a low of $7.3% but despite the heavy losses, the decentralized oracle token doesn’t seem to be out of the woods. LINK is facing a stiff resistance cluster ahead which could give it some strength to reject any upward price action. The critical hurdle is represented by the upper boundary of the descending parallel channel which formed as the prices were crashing down.

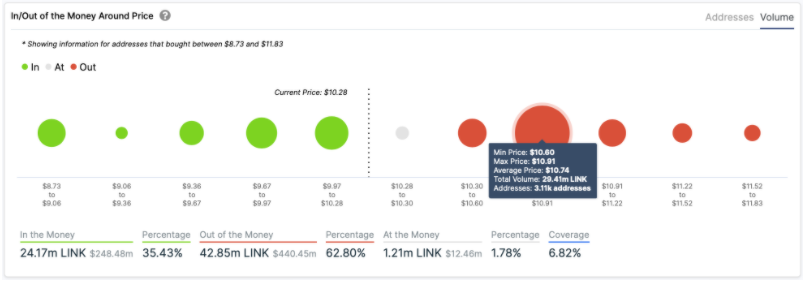

The rejection from this level could result in a steep correction to the lower boundary of the channel which is a level where the 200-day moving average is hovering. If you look into the In/Out of the money around price model, you can see a bearish momentum holding. Based on these on-chain metrics, about 3000 addresses previously purchased more than 30 million LINK tokens between $10.6 and $10.9. This supply will absorb any spike in buying pressure and will contain the rising prices at bay.

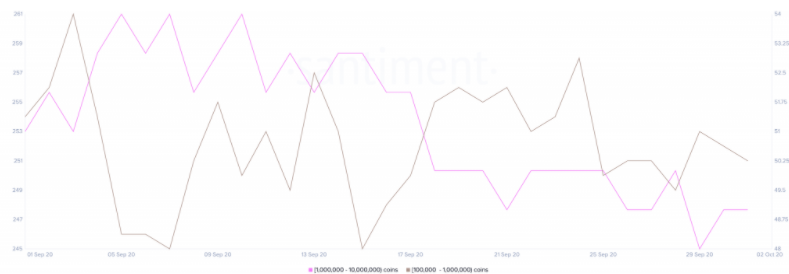

LINK’s price action suggests that the investors with millions of dollars in the asset known as whales are still offloading their holdings and the number of addresses holding 100,000 to 10 million LINK dropped by about 3.5%. 11 whales left the network or redistributed their tokens in a short while. The continuous selling pressure by the whales can bring more crashes in the prices when considering that they hold about $1 million and $100 million in LINK. Despite the strong chances of another decline, there was a huge spike in demand for the cross-chain data oracle token which could eventually jeopardize the outlook.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post