LINK technical formation could put an end to the multi-year uptrend of the altcoin and is no secret that the altcoin has been on the most bullish assets over 2019 and 2020 as we reported in the latest LINK news.

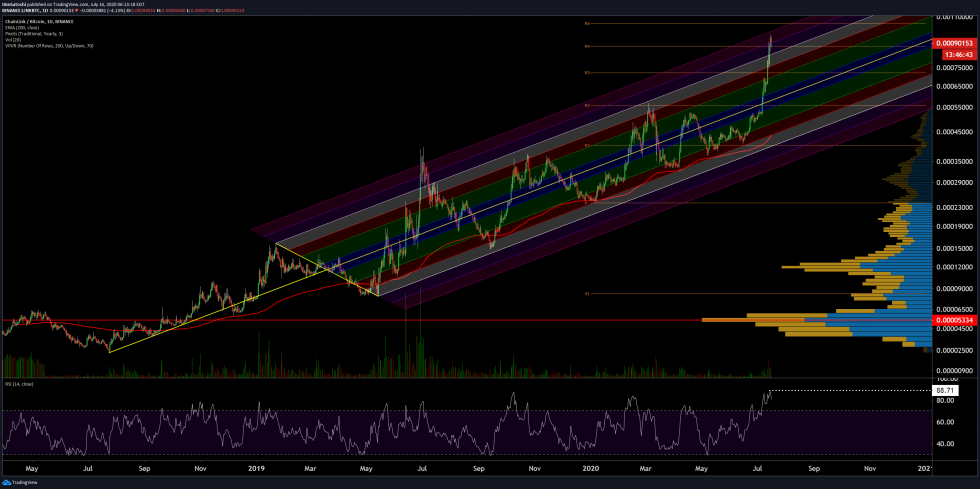

The cryptocurrency extended its parabolic momentum once it rallied to highs of $8.80. It’s possible that a combination of investor and hype “FOMO” could drive LINK higher which are some of the reasons why analysts are growing. One trader commented on the emergence of large rising wedge patterns as one factor could cause it to decline. Another analyst explained the LINK technical formation showing multiple factors that are showing overextended signs during the last rally. The confluence between the factors suggests a pullback is upcoming.

buy antabuse generic buy antabuse online no prescription

Chainlink’s impressive macro trend in the past few years is showing a few signs of slowing down as it was able to incur some momentum which sent the altcoin rallying over the previous price highs. This is not the only technical factor that is working against chainlink’s favor as the cryptocurrency flashed three other warning signs as the analysts are closely watching. At the time of writing, Chainlink is trading up at a current price of $8.45 which is around the same level it was consolidating over the past week.

It’s important to note that the cryptocurrency is trading slightly below its recently all-time of $8.80. This recent price action and the few rejections caused the cryptocurrency to form a huge rising wedge pattern. One analyst spoke about this in a recent tweet and offered a chart showing that this pattern has been formed in tandem with declining trading volume:

“Rising wedge in a bullish market. Bear trap or the end of the marine party? Stay tuned.”

The rising wedge is not the only thing that is showing downsides that can be inbound for the Chainlink price. Another analyst pointed to three concerning factors that showed an uptrend that seems overextended:

“I dont wanna be THAT GUY but LINK might be overbought here… 1. RSI ATH 2. Near R5 Yearly Pivot Res 3. PF Extension Diag Res… Next signals to watch for: 1. Bearish Reversal Pattern 2. Bear Div… There is an RSI bear div on the 12h already… 55k-60k sats would be my re-buy.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post