LINK suffers a huge downtrend as it seems it has topped the new all-time high of $20.3. However, Link could suffer a huge correction before the uptrend continues so let’s read more in the Chainlink coin news.

The retail investors remain bullish about the asset while whales started offloading their bags. The rising selling pressure affected the uptrend which will lead to a further retracement and if LINK validates this, the decentralized oracle token could drop to $14.7 or even lower. LINK is now recovering from the meteoric bull run pushed the token about $20, and even though the price is down by 11% since the all-time high multiple technical indexes predict more damage.

LINK suffers a huge downturn after the rampage when the price surged by more than 160% since the start of August where it invalidated the bearish signals which the multiple technical indicators presented. A huge bull run allowed the decentralized oracles token to hit the year-to-date return of nearly 840%. LINK’s speculation is rampant despite the huge gains posted recently. The data from LunarCRUSH shows that over the past day, more than 65 million mentions were registered over different social media networks while 68% of the social interactions were bullish.

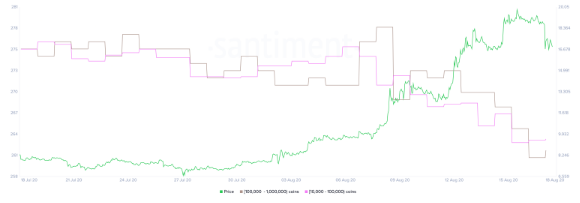

While the retail investors grow euphoric about the sudden price increase, the whales are offloading their bags as the data shows that the bigger LINK addresses were doing this long before the asset hit the all-time high. Santiment’s holder distribution data shows that some of the biggest whales on the network were offloading the bags on the market since August started. Since then, the number of addresses that hold 100,000 to 10 million LINK is on a decline while 64 whales left the network, representing a 2% decline.

The increased selling pressure is also pushing Chainlink down. The prices of the token dropped by 18% since the peak and multiple technical indexes suggest that the asset is bound for more losses soon. The TD sequential indicator proves to be essential in determining the local tops for the price. This index was able to predict the exhaustion points for LINK over the past three months. When the asset surged to a high of $4.6 as the TD setup presented the selling signal in the form of a green nine candlestick.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post