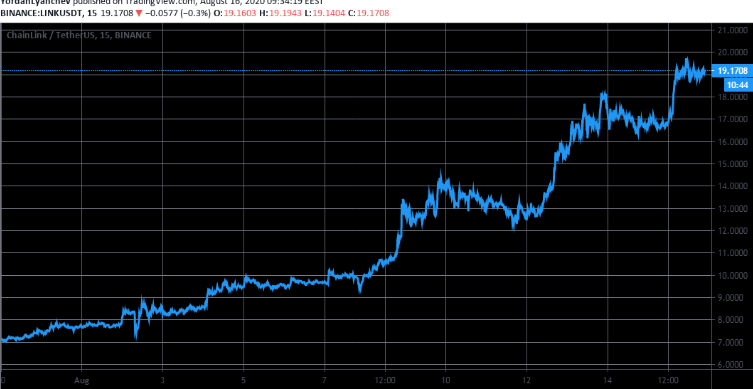

LINK recorded a $20 ATH and is still marching higher as Bitcoin remains stable while seeing its market dominance reduced to 58% as we are reading further in the latest chainlink coin news.

After a few minor fluctuations from $11,750 to $12,000, BTC lowered its volatility level and started trading at $11,900. At the same time, most of the other altcoins continue to be volatile as some coins such as EOS, YFI, and KAVA also made some impressive gains. The altcoin market was not boring and the past 24-hours confirm it. As LINK recorded $20 ATH, the coin has only attached to the previous ones since it broke the $6 level in early July. Then it managed to conquer the $10 level which seems like a long time ago.

Just a few hours back, LINK charted a new all-time high and with the latest price developments, it is safe to assume that it is only a matter of time before the coin overcomes this level as well. EOS for example also increased by 12% and approaches the $4 level which is the highest level for the coin charted since early March. Tron is also up by 6% after the recent strategic partnership with waves that aims to enhance the mass adoption in the Defi space.

The most impressive gainers were of course, the lower cap altcoins that are Defi related. Reserve Rights for starters is up by 40%, Kava by 24%, Yearn.Finance by 22%, Status by 13%, Ren by 12%, and BAND by 10%. In contrast, Swipe lost about 8% of its value, 0x lost 7.5%, and kyber network lost about 5.5%.

Bitcoin remained mostly calm despite the few sharp smaller moves. The main cryptocurrency elevated from the daily low of $11,750 to $11,950 in a matter of a few minutes. It then later made another attempt to challenge the $12,000 level but without success. At the time of writing, bitcoin trades between $11,800 and $11,900 which is close to the 2020 high of $12,100. If another rejection comes along and the asset starts going south, it will rely on the $11,400 and $11,000 level as a support. As BTC didn’t gain a huge chunk of value in the past day, some other altcoins increased which means that its dominance over the market decreased to 58%.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post