LINK potential HS pattern could start another sharp decline with a short-term top near the $12.98 as we can see more in the latest chainlink coin news.

A head and shoulders pattern was forming which could trigger a sharp decline below the $11.50 support. The LINK token price started a fresh decline after failing to clear the $13.00 resistance against the US dollar. The price is holding the $11.50 support level and the 100 simple moving average. There’s also a crucial contracting triangle forming with resistance at $12.00 on the 4-hour charts of the pair. A hear and shoulders pattern seems to be forming with support close to the $11.40 and the $11.50 level.

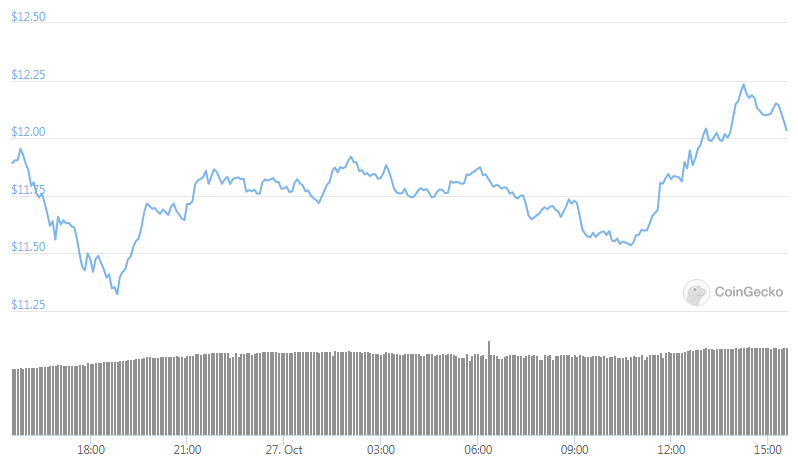

Over the past week, we saw a sharp increase in LINK’s price above the $11.50 and the $12.00 resistance level. The price broke the $12.50 resistance and settled above the 100 simple moving average. The new monthly high was formed close to the $12.98 and the price started a downside correction. There was a break below the $12.00 support level with the bears being able to push the price below the $23.6% fib retracement level from the upward move at $9.79 swing low to $12.98 high.

The price found support near the $11.40 zone and remained well bid above the 100 simple moving average. The 50% retracement level from the upward move at $9.79 swing low to $12.98 swing high acted as support. It is now consolidating the losses but it is facing a few key hurdles. It seems that the crucial contracting triangle is forming with resistance close to the $12.00 on the 4-hour charts for the pair. what is even more important, there’s a potential head and shoulders pattern forming with support close to the $11.40 and the $11.50. If the price climbs higher to $12.40 resistance and fails to continue higher, there’s a risk of sharp decline again. The LINK potential HS pattern could eventually start the decline.

In the stated case, the price could drop heavily below the $11.40 support and the 100 SMA. If Chainlink’s price breaks the triangle resistance and speeds up above the $12.40 resistance, it could invalidate the mentioned bearish scenario. the major resistance on the upside is still near the $13.00 zone so a successful close above the $13.00 level could open the doors for a push towards the $15.00 level in the upcoming days.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post