LINK and Aave hit an all-time high today, surging in tandem with BTC but analysts wonder why are the DeFi tokens rallying so hard? Let’s try and find out in today’s altcoin news.

Aave surpassed $200 for the first time in history while solidifying the positions as the fourth-biggest DEfi token Uniswap. Chainlink kept its position as the biggest DeFi token by market cap, valued at around $9 billion so both of these, LINK and AAve hit an all-time high in the latest DeFi rally thanks to the increase in demand and as well as the growth of the mainstream interest. Billionaire investor Mark Cuban spoke about Aave in one tweet which surprised many. He noted moving funds from Aave is extremely expensive because of the gas costs on ETH so to use it, users have to process transactions through the ETH blockchain network.

ETH is decentralized and processes info via smart contracts so for every transaction the users have to send a transaction fee in a “Gas form.” The cost of gas increased dramatically due to the overwhelming demand for ETH. Pinpointing the clogged ETH network, Cuban explained:

“Except the gas is always an issue. Just the cost of moving crypto to AAVE is crazy expensive and the number of non crypto options will increase.”

Most industry executives stated that Cuban’s interest in Aave shows that the entire Defi space became mainstream over the past 12 months and the value locked in DeFi even surpassed $23 million, reaching all-time highs consistently. LINK is a blockchain network that specializes in oracles and these are crucial to DeFi protocols because they provide more accurate price data to Defi platforms. Therefore, Chainlink and Aave will mostly benefit from the fast-growing DeFi market.

Where I think there is a disconnect is in addition to the supply and demand / scarcity its possible he is discounting the utility of Bitcoin.

There is real value in being able to send $ over a decentralized permissionless network.

— Haralabos Voulgaris (@haralabob) January 12, 2021

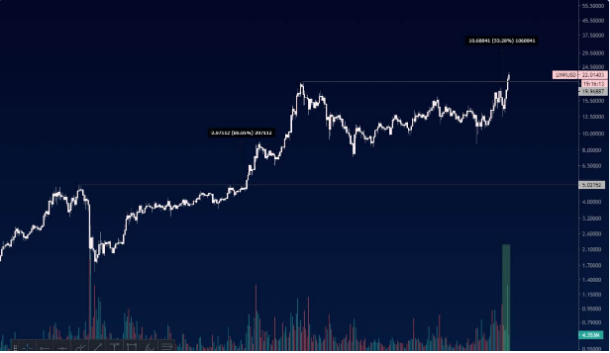

According to a crypto trader known as “Cantering Clark” the $30 price range for Chainlink in the near future is quite conservative as he wrote:

“The last break paused for a moment before ripping up 80% before any significant correction. Break of an ATH is a green light for strength. Expect a delay in follow-through always. I think a 30$ $LINK soon is clearly conservative.”

Some believe that the upside potential of Chainlink is limited relative to other DeFi tokens with its $9 billion in valuation and other major Defi protocols are still valued below $2 billion. Soon enough, other core pillars like DeFi or SushiSwap and Synthetix will be the next best-performing Defi tokens like Chainlink and Aave. For example, we saw a massive spike in price after seeing an increase in the trading volume of Sushisawp after the merger with Yearn.Finance.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post