Chainlink’s bearish signals around the coin are raising the questions about the sustainability of LINK’s uptrend despite its rise to a new all-time high as we are reading more in the upcoming Chainlink news.

Chainlink is trading up and hit a new all-time high of $10.3 but multiple fundamental and technical indexes are flashing selling signals as the spike on selling pressure could see it pull back to $8. The decentralized oracle token stole the spotlight after it outperformed most digital assets this quarter. Despite hitting new all-time highs, on-chain and technical metrics are showing that the asset is ready to retrace.

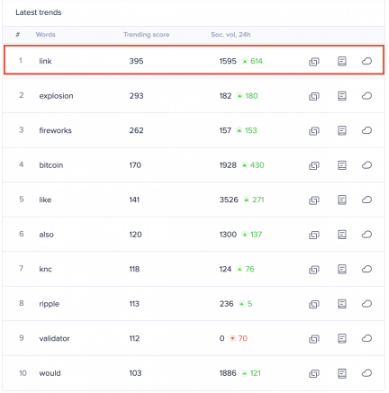

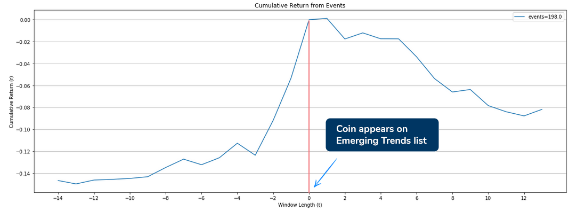

Chainlink’s bearish signals are clearly seen on the charts as the traders believe that LINK is already overbought. The data reveals that the number of LINK-related mentions on different social media networks increased dramatically. The numbers show that LINK entered the FOMO phase. The rising around the oracle token allowed it to move to the number one spot on Santiment’s Emerging Trend list and the high level of notoriety is not a good sign according to Dino Ibisbegovic who is the head of content and SEO at Santiment.

The analyst maintained that when the crowd pays increased attention to a cryptocurrency in a time when the prices are pumped, the movement is usually followed by a steep correction, according to Ibisbegovic:

“Within the next 12 days after a coin claims a top 3 position on our list of Emerging Trends, its price drops by an average of 8.2 percent. Based on our study, once the increased crowd attention subsides (which usually happens in a matter of hours/days), a short-term price correction—or consolidation—is often a likely outcome.”

LINK’s uptrend seems to have reached exhaustion after the investors became quite bullish about the price action. Since the peak, the cryptocurrency got down by 3.7% and a widely known technical index showing that the asset could drop further. The TD Sequential indicator supported the thesis that Chainlink is bound for a strong correction and the sell signals are presented in the form of a green nine candlestick. The bearish formation has yet to be confirmed but the near-term future doesn’t look bullish.

If another correction happens, there is a crucial supply wall below the token that could hold the falling prices. Based on these metrics, about 27,000 addresses already bought 30 million tokens between $7.6 and $9.7.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post