Chainlink and kyber network surge in price due to the strong developer activity and the expanding utility of the tokens. In today’s Chainlink news, we read further about the price gains as both companies are using Chainlink’s technology to access the off-chain data and to enhance the legitimacy of LINK.

The Kyber Network is working to launch Kyber DAO and Katalyst by the end of Q2 2020 which added to the investors’ optimism. LINK and KNC increased by more than 80% in April and it seems that there are more gains to come. Chainlink and Kyber network showed huge price growth this month since the software development activity is another major indicator that could predict where the assets’ price is going next.

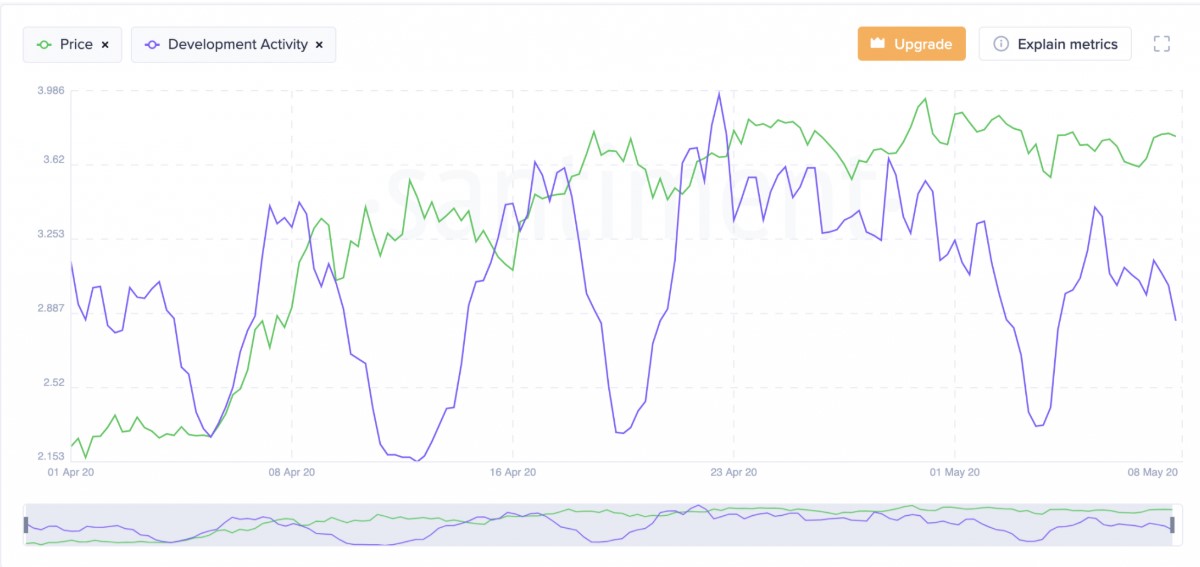

Chainlink was staying true to the long-term roadmap and it seems that Chainlink showed robust development activity over the past month according to Santiment. The decentralized oracles skyrocketed in April after the announcement of the new partnership with Cypherium which is an enterprise-focused blockchain platform to give them the access to integrated smart contracts which are secure end-to-end. Acala Network revealed that they will use Chainlink’s network to supply robust price feeds to the DeFi applications running on Polkadot. IrisNET, another firm integrated Chainlink to support the interchain interoperability.

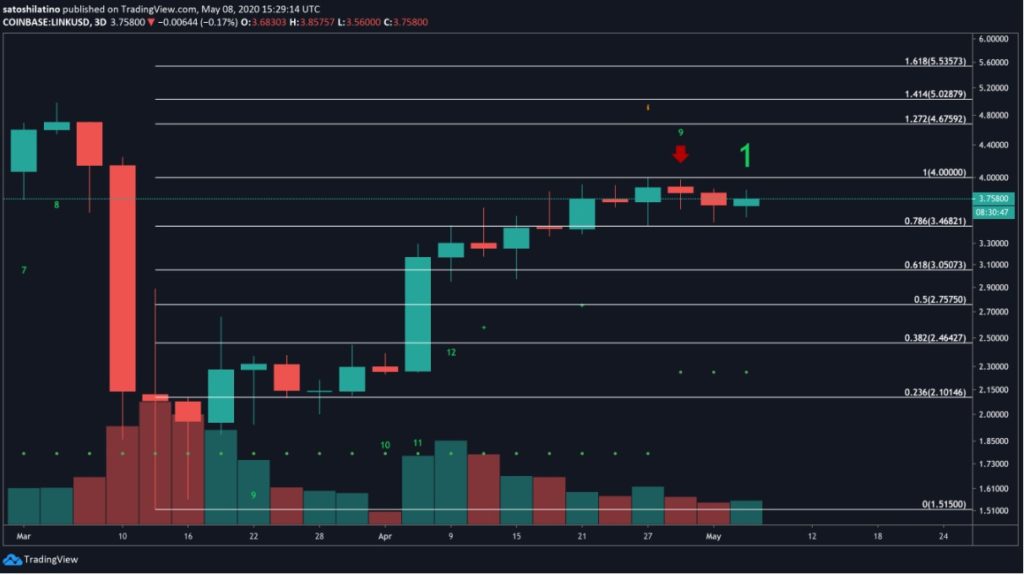

As Chainlink expands its use over the entire crypto industry, it enhances its use cases and value for everyone that build smart contract applications. This is one of the reasons why so many of the investors believe LINK which is visible from the price charts. The token saw its price increase by more than 90 percent in April to a high of $4 by the end of the month. It seems that LINK could be bound for another correction in the short-term.

The TD sequential indicator presented a selling signal in the form of a green nine candlestick on the charts. The bearish formation represents a one to four candlestick correction before LINK continues its uptrend. An increase in the selling pressure, LINK will even break below the 78% Fib retracement level which can validate the pessimistic outlook. The next major level of support to watch out for the 61% FIB retracement level.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post