Terra’s DEFI apps got drained out of $28 billion after the recent Luna collapse and investors largely exited the ecosystem while the rest of the DeFi protocols remained skeptical about the long-term prospects so let’s read more today in our latest cryptocurrency news.

In the two weeks since Terra’s US dollar stablecoin UST lost its peg, it caused massive investor losses and billions of dollars were taken out of the ecosystem. The data from the trackers show the funds held in DEFI apps built on Terra crashed to $155 million in locked value which is a level last seen in February 2021 from more than $29 billion and the locked value on Terra DEFI peaked at $30 billion in April. The declines came as UST lost its 1:1 peg against the US dollar amid the crash in the markets. This created a death spiral as investors exchanged UST for the rest of the stablecoins and sent the Terra token to lower than 4 cents.

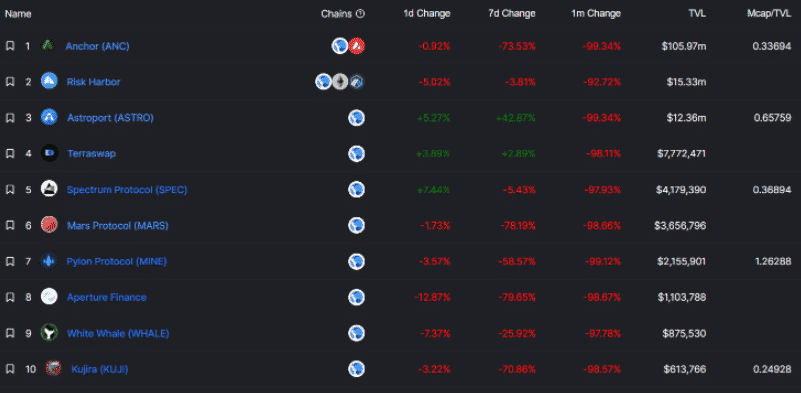

Analysts claim that when a project experiences major losses like this one, it is one of the fastest ways for a protocol or a blockchain in the space to lose the trust of the community. Most of the lost value was on the lending protocol Anchor which took a huge hit as well, holding $17 billion on May 6 and locked up over $106 million on Friday marking a drop of 99%. Anchor was home to Terra’s infamous stable yields where the investors could lock their UST to earn about 19% on a yearly basis.

The market observers raised red flags about Anchor’s yield with the critics calling it unsustainable and this didn’t deter the investors from piling over $16 billion from last year. Other apps showed similar percentage drops. Lido pays out the daily rewards on the staked assets and saw a $7 billion drop inv value while Mars Protocol and Astroport saw a combined $1.2 billion drop in the TVL.

The price of the LUNA token also crashed by as much as 99.7% in less than a week so one UST can be redeemed or minted for $1 worth of LUNA t any time which is a mechansim that’s meant to keep the UST value stable. As a result, when UST fell LUNA was minted to try and maintain the peg but this time it failed to revive it as a sentiment for the token among crypto investors which also dropped. The slump caused some of the biggest companies on the market to suffer major losses. The developers also put a revival plan in place to try and recover the ecosystem and ensure long-term growth.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post