Solana’s price gets knocked down over and over again because of the many network outages that it experienced as we reported in the previous blockchain news.

The past month was a bearish month for almost all cryptocurrencies. The sector’s market cap dropped 33% to $1.31 million and Solana’s crash was among the most brutal. Right now, SOL has seen a 50% correction and trades at 51 with the network aiming to overcome the Ethereum blockchain scalability problem by incorporating the PoH mechanism in a PoS blockchain. With the Proof of history model, Solana delegates a central node to determine a transaction time that the entire network can agree on.

The low fees delivered by the Solana network enticed the developers and users alike but the network outages continue to cast doubt on the centralization issue and possibly scared away many investors. Pinning the underperformance to the 7-hour outage on April 30 also seems simple but it doesn’t explain why the decoupling started a month before that. According to Solana Labs, the issue was caused by bots that launched plenty of transactions on Metaplex which is an NFT marketplace built on Solana.

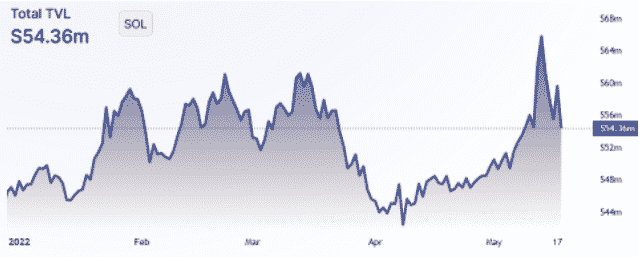

The transaction volume surpassed six million per second at its peak and overflowed nodes which as a consequence, validators ran out of the data memory leading to a loss of consensus and network interruption. To avoid this issue, the developers introduced three steps, changing the data transfer protocol, fee-based execution priority, and stake-weighted transaction processing. Solana’s main decentralized application metric showed weakness earlier in November after the total value locked on the network that measures the amount deposited in the smart contracts failed to sustain levels above 60 million sOL.

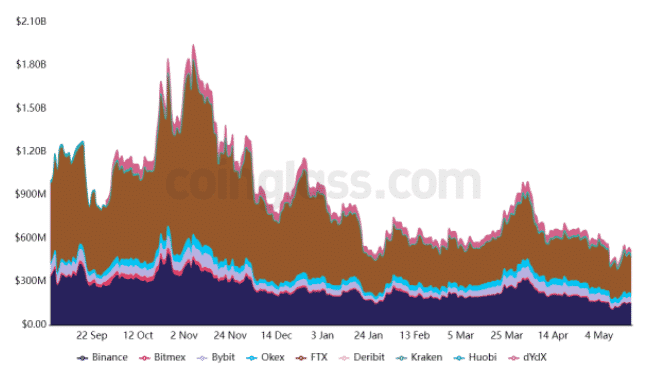

The 50% price correction had other factors than just a reduced TVL and to confirm whether the dapp use decreased, the investors should analyze the number of addresses in the ecosystem. The above chart shows that Solana futures open interest dropped by 22% in the past month to $510 million. This is concerning because a smaller number could reduce the activity of arbitrage desks and the market makers. It’s impossible to quite pinpoint the exact reason for the Solana price drop but the centralization issues after plenty of network outages and the decrease in the network DAPP use, are some of the factors contributing to the decline.

The data reviewed in the article suggests that Solana holders should not expect a price bounce anytime soon because the health metrics remained under pressure. If the sentiment improves, there should be an inflow of deposits and an increase in the Solana TVL with the number of active addresses.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post