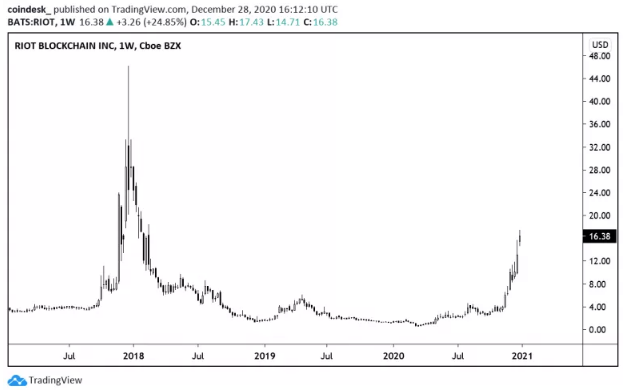

The Riot Blockchain mining company has just passed $1 billion in market capitalization after surging by 13% in the early trading hours as we can see more in today’s crypto news.

The shares of Castel Rock gained over 1250% in 2020 and now trades hands above $16. Over the same period of time, BTC gained about 280%. Riot Blockchain issued about 17 million shares since November with a total of 67.5 million shares according to the data collected by ycharts.com. The Riot blockchain mining company expanded its size and sophistication of the mining operations in 2020 including the planned pilot project back in Texas to test water immersion and cooling technology by also purchasing over 31,000 new ASIC mining machines.

Riot shares opened on Monday at 18% higher than the Christmas eve close. The company pivoted its business model from biotech to BTC mining in October 2017 when the value of the company was less than $50 million.

As reported previously in our news, Riot Blockchain- a Nasdaq-listed company previously known as Bioptix, turned out to have major material weaknesses according to auditors reports. Since 2018, Riot Blockchain had about $225,000 compared to the previous $42 million when the bitcoin price reached its all-time high. In the meantime, the company’s mining operation was able to generate about $7.7 million in revenue. The revenue comes after the production of 1,081 bitcoins including Bitcoin Cash and 3,023 Litecoins for the same year. The company’s auditor warned that Riot failed to maintain ‘’proper financial reporting protocols.”

If the financial statements of the company reflect the management history of Riot Blockchain, it’s no wonder why they are under constant investigation. After the company changed its name, Riot had three changes in the CEO positions. Most recently, the company chose Jeff McGonegal to be the new CEO. In 2018, John O’Rourke, now ex-CEO of the company, resigned after he was charged with market manipulation by the SEC. The charges were, however, not related to Riot Blockchain. After John, Chirs Ensey was hired as an interim CEO during the restructuring of the company but has since left Riot.

Riot Blockchain is one of the few Nasdaq-listed companies in the US that is dedicated to crypto mining. The Oklahoma-based company invested about $5 million in 4000 Antminer S17 pro equipment on December 4 last year and it claimed that the cost-effective machines will allow it to achieve a 50 percent improvement in the hardware power efficiency that was compared to the S9 miners that are currently in use.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post