Mt.Gox creditors suffered more than a million in fees since March and are having a hard time understanding why about $200,000 is spent every month by the trustee when few details are provided so let’s read more in our crypto news today.

The trustee for the defunct exchange Mt.Gox spent another $1.2 million in fees over the past six months according to the update posted on the forums today. As usual, the creditors are complaining that the bankruptcy trustee of the exchange Nobuaki Kobayashi, gave only a few updates on why the money was spent on and is there any progress being made. One creditor commented:

“Not much of an update. The usual report on finance. $1.2m consumed in the last 6 months. No update on Vinnik, NZ, FinCEN or new recoveries.”

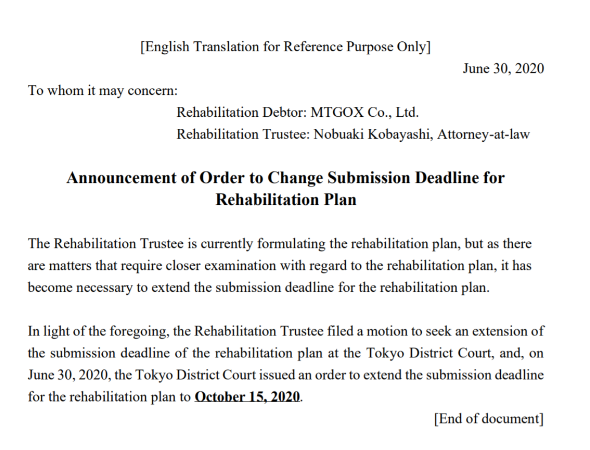

As reported previously, Mt.Gox was one of the biggest BTC exchanges which closed down in 2014 after suffering an extended hack of about 650,000 Bitcoin that is worth $4.3 billion today. The creditors are still waiting for refunds after Kobayashi received the remaining funds of the platform which are about 200,000 BTC as its rehabilitation trustee. Since 2019, Kobayashi delayed the refund process a few times publishing a few identical statements each year. The current submission deadline for the rehabilitation plan is October 15 but Mt.Gox creditors suffered enough and they are worried more than ever now if they will ever get their money back.

As reported earlier, The Mt.Gox trustees announced they have 150,000 BTC to repay its users and many wondered whether their decision will start a correction on the market anytime soon. There’s growing speculation that 150,000 BTC from the Mt.Gox trustee will happen in about 10 days but many factors suggest that it is highly unlikely. Between 2011 and 2013, Mt. Gox lost about 850,000 BTC in the biggest hack attack in history and the trustee now has 150,000 BTC to repay the users that lost their funds in the breach. However, there are a lot of things to be done before the funds can be issued. The refund process was delayed a few times before and the refunds will not happen anytime soon according to analysts.

Some investors suggested that it could cause 150,000 BTC to move which could eventually rattle the market. There are two key reasons that the trustee will not move BTC in the near term while the extension pertains to submit the rehabilitation plan by not refunding the coins. The latest deadline is for the trustee to put a plan not to actually refund the investors.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post