Gemini unveils the Gemini Custody services as the new institutional-grade crypto storage which will allow investors to store 18 cryptocurrencies and tokens from Bitcoin to MakerDAO and BAT. So in today’s coming altcoin news, we take a closer look at the new services.

Cryptocurrencies are naturally decentralized so the investors have been struggling with the security issues for years. While the hardware wallets such as Trezor or Ledger cold storage device is one of the best options to store your funds, many of the consumer investors, institutions and larger holders are not exactly willing to put the safety of the funds into a small USB-like looking device that can easily be lost. The companies thus invested millions into launching custodial services which provide a bigger layer of security to the crypto equation. Big companies such as the Intercontinental Exchange-Bakkt and Wall Street’s Fidelity Investments have already developed such services.

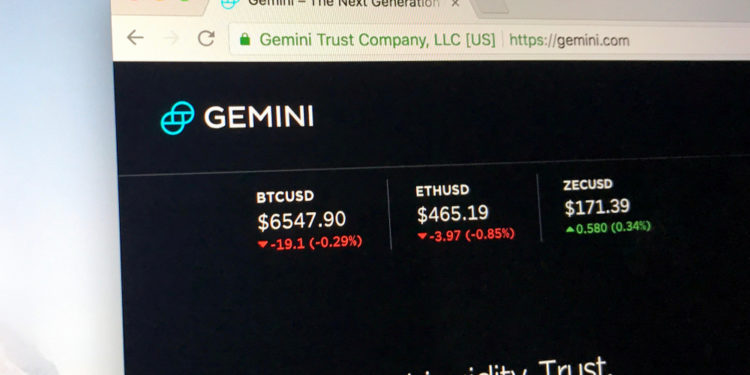

Gemini, the New York-based Bitcoin exchange and trust launched by the Winklevoss Twins is the latest company to add this new custody service to their platform. Gemini unveils the platform as the perfect option for those who are not willing to keep their funds alone. Aside from Bitcoin and Ethereum, some of the other assets that will be supported are Litecoin, Bitcoin Cash and some more ERC-20 based tokens including the Gemini Dollar. The CEO of the company Tyler Winklevoss explained:

“From day one, Gemini recognized the need for a world-class custody solution that is secure, compliant, and easy to use for individuals and institutions around the world.”

While this sounds just as any other custody solution added to the mix, the managing director of operations at Gemini, Jeanine Hightower-Sellitto explained that the new service will be supporting something that the company calls ‘’instant trading’’ giving the institutions the opportunity to trade cryptocurrencies from a safe environment. Gemini’s new product is arriving at a perfect time as per the SEC chairman Jay Clayton explanation, the security of Bitcoin holdings is the organization’s biggest concern on the market. The chairman also noted that the SEC should consider a Bitcoin ETF and a proper solution as well. The regulator did not explain whether or not he believes that the current solutions are good enough. However, with the new solutions such as Gemini’s the institutions are more likely to dive into cryptocurrencies, as the reports that we have in our latest cryptocurrency news also show.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post