The FTX exchange launched tokenized equities enabling traders to get their hands on stocks like Facebook, Netflix, Tesla, and Amazon. In our crypto news below, we find out more.

A huge part of the FTX audience comes from China while the US citizens don’t have access to the platform. One of the leading exchanges by volume, the FTX exchange, partnered with the European Financial companies CM Equity AG and Digital Assets AG to enable tokenized equity trading. The platform’s users will have access to top stocks like Amazon, Tesla, and Apple along with popular indices such as the S&P 500. The US along with other jurisdictions will not get access to the offering.

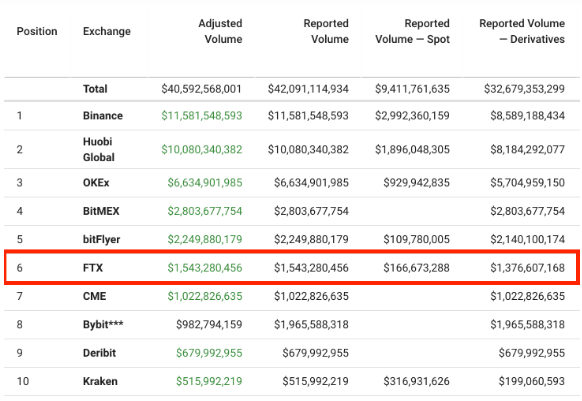

With about $1.5 billion trading volume as the exchange is the six-most popular trading venue that attracts a large audience of traders. However, this demographic has been accessing the traditional stock market according to CEO Sam Bankman Fried. A large portion of the FTX user base comes from China which is concerning for the American regulators considering the ongoing political frictions. CM Equity AG will hold the traded equities while the tokens will work similarly to depositary receipts or ETFs. So if a trader wants to hold the actual stock, they will have to go through CM Equity AG.

An important advantage of the tokenized securities is that the platform allows fractional ownership and this allows retail traders to make smaller deposits so traders won’t have to pay for custody and FTX will charge the trading fees. Merging crypto and traditional markets were a focus for many startups in the space so for example the decentralized derivatives platform Synthetix provides access to traditional equities such as NIKKEI and FTSE. Unlike FTX, the platform doesn’t provide ownership of the underlying assets.

Although the FTX exchange launched the stock options, it offers some regulatory risks, it is a huge step in building the crypto space credibility. As reported previously, The FTX founder has a new plan for the DeFi project Sushiswap right after it finished the liquidity migration. Bankman-Fried, the FTX founder said that he is first dedicated to ensuring that the project’s migration was successful. This means that the move of $180 million worth of sushi tokens, locked up in the liquidity pool Uniswap, was successful.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post