The ex-Polychain Capital Partner Tekin Salimi launched a $125 million crypto fund for a DAO which will be focusing on investing in early-stage protocols and blockchain companies so let’s read more in today’s latest blockchain news.

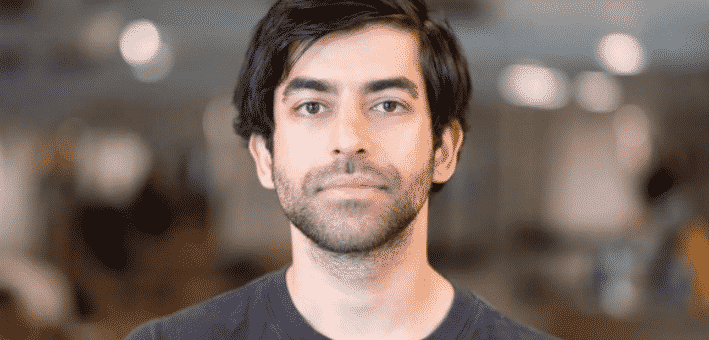

DAO5 is a $125 million fund led by Tekin Salimi and it is on track to become a fully founder-woned DAO by 2025. To help provide blockchain startups with early-stage funding, the ex-Polychain Capital partner is launching the fund dubbed DAO5. Salimi who is also a Blockchain Association co-founder said that DAO5 will become a full founder-owned Dao by 2025 because he believes it will take there years to invest about $40 million annually. After the initial money is invested, the fund will be dissolved and dao5 will return the limited partnership capital to investors and will convert the fund into a DAO for the community to use smart contracts, crypto, and Web3 tools to organize and incentivize participation and to share control among other group members.

Salimi will manage the fund and he also said that investors are eager to take part and that the fund is coming together in a few weeks. Emin Gun Sirer who is the founder of the Avalanche protocol and Do Kwon as well as Ben Fisch will serve on the Dao5 Advisory board. The focus will be to invest in early-stage protocols and blockchain companies so once the project is funded, the founder will get governance tokens and be used when the DAO5 comes to fruition. Exactly how many tokens each person will get is now decided yet. Salimi said:

“It starts with this centralized venture investing model. But the end state of it is basically a collective of crypto founders that control a new treasury of assets.”

Launching DAO5 as a fund came from the goal to start with better management and being able to pivot faster than if relying on thousands of voices in a chaotic Discord server or a Telegram channel. He added:

“There are a lot of challenges when you have a DAO that’s started with a specific purpose, because DAOs aren’t yet inherently good at management or making decisions or changing direction. So if there’s any ambiguity for that purpose, it can lead to infighting and uncertainty.”

Building talent and capital before deciding how to deploy it is the opposite approach taken by other DAOs but Salimi said that flexibility is valuable. He added:

“Nothing’s off the table. Open creativity is more important than following a set investment mandate or strategy. We’d like to do things radically different and skewed towards investing in stuff that we haven’t seen experienced before in crypto.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post