The Bitcoin SV long-term price analysis shows that the altcoin is running out of time and the breakout is imminent and going to be pretty important. The market of BSV is clinging on to the Bitcoin movement at the moment but BTC sustained the position above $10,900 for the first time being while BSV Lost proximity at the resistance of $165 as we are reading in the latest Bitcoin SV news.

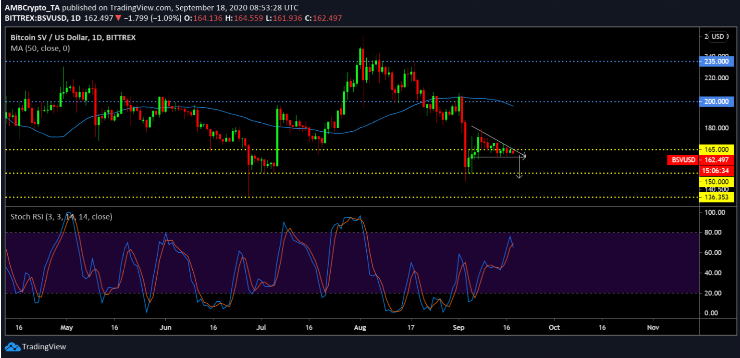

As explained earlier, Bitcoin SV’s past 72-hours showed major price movements and the asset is now showing a formation of a symmetrical triangle. The symmetrical triangle proclaims a 50-50 probability between the bullish and bearish breakout so the signs are also showing that a correction is upcoming. The Relative Strenght Index or RSI is barely maintaining a neutral position with the sellers continuing to show high pressure.

The Bitcoin SV long-term price analysis shows that the Awesome Oscillator or AO, suggests a similar conundrum as the bullish momentum is showing extinguished signs at the moment. The increase in bearish momentum was not witnessed either so the trend has to strength in the next two days in a similar stagnant phase.

buy aciphex generic buy aciphex online no prescription

With the 50-moving average as a strong overhead resistance, the chances of a bullish breakout are dropping for Bitcoin SV. The 1-day charts clarify that the bearish trend is here to an extent. The stagnancy over the past few days is clear but the formation of a descending triangle seals the deal.

Bitcoin SV could not be able to close a position above the $165 level unless the biggest cryptocurrency pulls above again but the signs are showing a drop at the moment. The breakout could take place in the next week with the price testing support of $150 once again. A further correction could lead to a drop to the $136 level. The Stochastic RSI shows that the bearish pressure is finally coming in terms and that the signal lines exhibit minor crossovers to the RSI line. This trend will shift towards a breakdown at any moment with the crossing over the RSI line.

As recently reported in the Bitcoin SV news, BSV’s principle of sticking to the original version of Satoshi Nakamoto seems to be paying off. The independent research firm that specializes in digital currency, Fundstrat released a new assessment of Bitcoin SV and the conclusion is that it is ready for enterprise usage.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post