A new annual report from the Bitcoin Association which stands behind the Bitcoin SV (BSV) altcoin now claims that Bitcoin SV is rivaling VISA for transactions per second. The cryptocurrency apparently offers miners “better returns” than the flagship cryptocurrency, Bitcoin (BTC).

In the latest cryptocurrencies news, we can also see that The Bitcoin Association, which promotes Bitcoin SV, said that the BSV network now rivals credit card processor VISA in terms of transactions per second. The report also claims that the BSV transaction processors (miners) receive “better returns” than on BTC.

As the first annual report, the Bitcoin Association (BA) said that the Bitcoin SV (BSV) scaling test network had “consistently sustained 1,300 transactions per second for prolonged period, in addition to handling a peak load of 6,400 transactions per second.”

“To put the transaction capacity in perspective, the VISA network, which has long been viewed as the gold-standard for payment processors, handles an average of 1,700 transactions per second.”

Bitcoin SV is now in a battle with VISA because of this, and the issuers of the report said that the test network has processed blocks of almost 2GB in size, containing more than 7.8 million transactions.

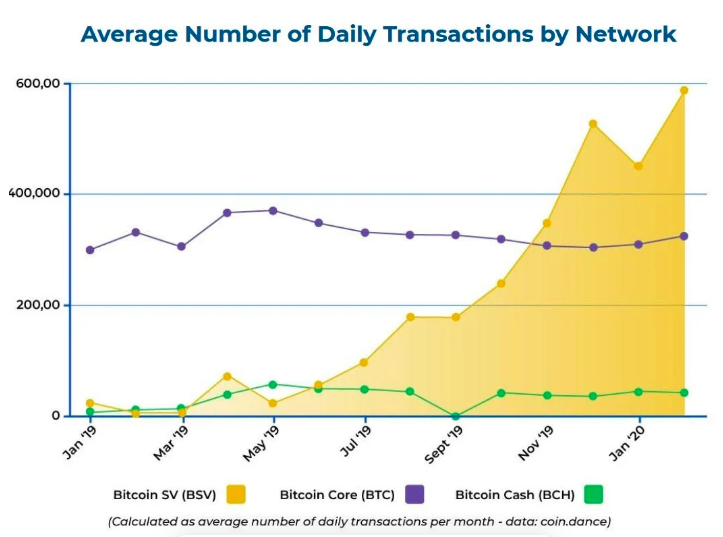

In the Bitcoin SV news today, we can also see that BSV along with Bitcoin Cash (BCH) emerged out of the scaling debate over Bitcoin. The debate centered around claims that the BTC network’s inability to process more than a handful of transactions per second meant that it could not achieve mainstream adoption. BCH and BSV both pursued block sizes as a way to scale.

In the annual report, we can also see the period between February 2019 and February 2020, where BSV is making some bold claims such as the following:

“Bitcoin SV is emerging as the most profitable Bitcoin network for transaction processors (miners) to be working on, offering better returns than BTC on the majority of days from September 2019 to February 2020.”

However, Messari put Bitcoin SV’s transaction fees over the past 24 hours at just $255 while Bitcoin raked in $214,199 in transaction fees. It is still unclear in the report how BA arrived at their conclusion of fees.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post