Rug Pulls are the go-to scam method for the year according to the Chainalysis report showing that it accounts for 37% of all crypto scam revenue in 2021 as we can see in today’s crypto news.

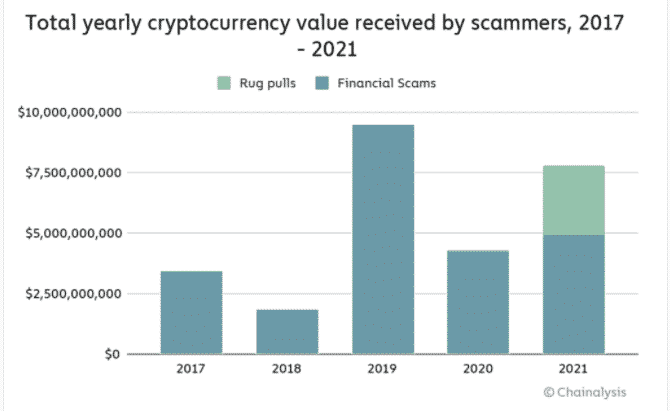

Rug pulls are the go-to form of crypto-based crime by transaction volume according to a report by Chainalysis. This year’s crypto scam revenue reached $7.7 billion or an 81% increase compared to a year ago. Compared to 2020, this year’s crypto scam revenue increased dramatically but it still doesn’t top the all-time high reached in 2019. The report singled out the Finiko Ponzi Scheme that targeted Russian speakers in Eastern Europe and took in more than $1.1 billion from victims in 2021. The report added:

“While total scam revenue increased significantly in 2021, it stayed flat if we remove rug pulls and limit our analysis to investment scams–even with the emergence of Finiko.”

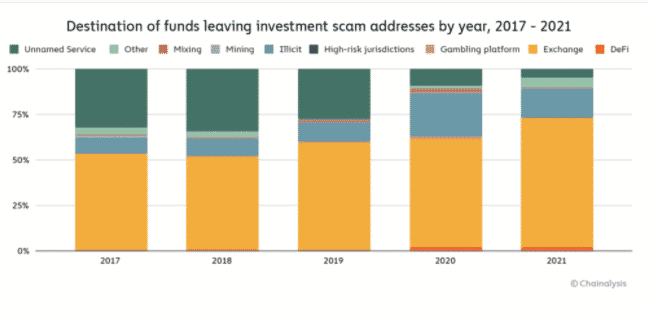

According to Chainalysis, this indicates that there were fewer individual scam victims while the average amount of each victim increased. The report noted that the scammer’s money laundering strategies are unchanged compared to other years since most crypto sent from scam addresses ended up in mainstream exchanges. In 2021, the rug pulls plagued the Defi ecosystem and garnered over $2.8 billion worth of crypto from victims. Rug pulls are the preferred method of scamming while still being a fairly new type of exit scam that orchestrated the project insiders that drain the funds from the liquidity pool causing the tokens’ price crash. They accounted for 37% of the crypto scam revenue in 2021 versus 1% in 2020. Chainalysis noted:

“It’s important to remember that not all rug pulls start as DeFi projects.”

The Thodex scam where users lost over $2 billion worth of crypto, accounts for 90% of all value that was stolen in rug pulls this year. Other 2021 rug pulls began as Defi projects with Uranium Finance and AnubisDAO counting as the biggest scams in history as well as the Thodex scam that lost over $2 billion worth of crypto. The report noted the average lifespan of financial scams continued to be shortened that could explain why the financial scams rose dramatically in 2021 from 2052 to 3000 in 2020. one reason for this could be that the investigations are getting much better at investigating. According to Chainalysis, another thing that changed is the statistical relationship between the crypto prices and the scams suggesting that the crypto sector is maturing.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post