The yields put pressure on Bitcoin after it posted a strong recovery during the weekend session but it looks weaker now as the week started so let’s take a closer look at today’s BTC price in our Bitcoin news.

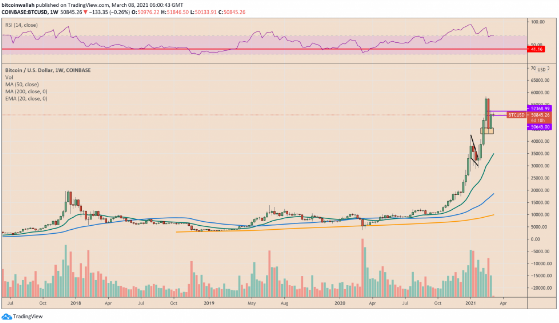

Microstrategy’s accumulation of the cryptocurrency and the additional stimulus package from the US government provide tailwinds to the price rally while the Treasury yields put pressure on BTC. The price retraced from its upside weekend session against the prospects of the current rise in the US borrowing costs and as of today, the BTC/USD Exchange rate held support above $50K following a pullback from its Asian session at $51,846. The modest decline appeared on profit-taking sentiment right after BTC closed the week up by 12.71% according to the data by Coinbase.

The last week’s upside momentum came in response to the BTC Bearish stretch in the week where it dropped by 21 percent and recorded its worst seven-day performance since the COVID pandemic started in March. The price action shows a medium-term uncertainty among the traders. BTC will correct lower to stay in course of the weekly choppiness but the traders are going to realize the short-term profits against macroeconomic uncertainties that were led by the current situation with the US bond yields. In the meantime, big firms with a long-term bullish outlook on BTC could absorb the selling pressure while the prices surged on Monday and the selloff started shortly after.

Jerome Powell on the other hand failed to provide more guidance on the rising rates and at one point in time, the pair dropped to as low as $46,219, marking a 12 percent drop from its week-to-date high. The same day, business intelligence company Microstrategy announced another $10 billion purchase of BTC. the company purchase bought its net BTC reserves to 91,064 BTC that are now worth $4.63 billion and made more than 100% profits so far.

Now, the Senate passed Biden’s $1.9 trillion COVID stimulus bill and a part of the upside sentiment also took cues from the prospects of a US Dollar liquidity into the system. In the meantime, BTC faces headwinds from a rise in the US Treasury yields with the interest rate returns surging to 1607 last week which is the best level since the pandemic started.

buy filitra professional online nouvita.co.uk/wp-content/themes/twentynineteen/fonts/en/filitra-professional.html no prescription

With Powel’s decision to follow and wait for the decision, it seems that a lack of the central bank’s intervention will keep pushing the long-dated yields higher.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post