Wrapped BTC records highest volume of $143 million on Uniswap as the BTC holders put their assets to work on the ETH blockchain as we are reading more in today’s BTC news.

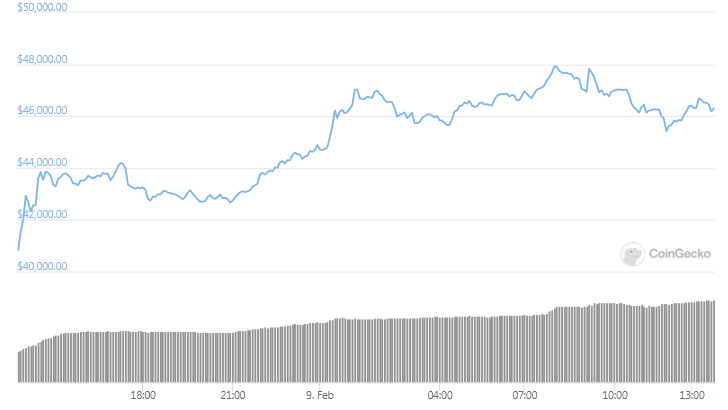

The trading volume on Uniswap for Wrapped BTC records the highest volume ever of nearly $143 million. More than 166,000 BTC were transferred to the blockchain and the daily WBTC trading volume on Uniswap increased by 100x since September last year. 22Bitcoin’s price is close to the all-time high but this is not the only metric rising to record levels as wrapped BTC is trading on the Uniswap exchange and it is growing.

Uniswap’s trading volume for WBTC increased to a new single-day ATH of $143 million according to the blockchain data provider Glassnode which recorded a stunning rise that has seen BTC worth hundreds of millions of dollars to make its way into the ETH blockchain. WBTC or wrapped Bitcoin came into its own as a huge component of the growing Defi ecosystem since 2020 and the increased decentralized exchange volume proves that the on-chain crypto trading appetite is increasing.

DeFi or decentralized finance uses automatically executed scripts such as smart contracts to provide financial goods and services like swaps, loans, and deposits using decentralized blockchain networks instead of trusted third parties such as banks. DeFi is being developed on a few blockchains but the majority of the volume and activity is residing on the ETH network. Wrapped BTC was initially created to help BTC holders get into the action by depositing native Bitcoin within a network of trusted custodians so that the holders can get WBTC in return at 1:1 ratio.

WBTC creates a way for DeFi traders and other ETH network users to gain exposure to BTC without the need to set up a native BTC Wallet and infrastructure. This could help explain Uniswap’s WBTC volume reaching new highs within days of the BTC price pushing to a new height. The WBTC volume was rising for a few months from an average of $1 million per day to $100 million per day since the start of February 2020. Combined with other BTC on-chain tokens that are on the Ethereum blockchain, are also on the highest level of more than 0.75% of the entire BTC supply.

DeFi keeps on increasing and attracting even more BTC as the bull market effect goes on. With ETH being the platform for putting crypto-assets to work, we can only wonder how many more BTC will find their way into the DeFi chain.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post