The Bitcoin on-chain analyst Willy Woo thinks that retail hasn’t bought the dip so hard since the last Covid market crash so let’s read more in today’s Bitcoin price news.

Ever since the drop on December 3, Bitcoin’s price was struggling to move past the $50,000 resistance level and while the price continues to move sideways, the market watchers are wondering how the year will end and will there be another rally with support set at $46,000. Despite the tight trading range in the past two weeks, Bitcoin on-chain analyst Willy Woo pointed out indicators that are showing no signs of a bear market.

The last time retail bought the dip this hard was at the bottom of the COVID crash.

Probably nothing, few, etc etc. pic.twitter.com/HuxNxYMl48

— Willy Woo (@woonomic) December 14, 2021

Willy woo says retail investors are taking advantage of the bearish price and are buying the dip more than the usual:

“The last time retail bought the dip this hard was at the bottom of the COVID crash.”

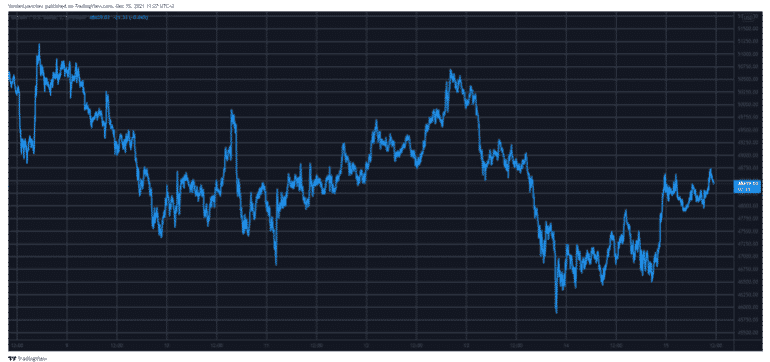

Buying the dip visualised (spot volumes seen on-chain). It has been happening, it's moderate, but most importantly, as yet there's no signs of a further sell-off cascade. Also worth keeping in mind longs have already been flushed. pic.twitter.com/j5cjUOIGmA

— Willy Woo (@woonomic) December 13, 2021

He also left some room for discussion between his followers to decide whether the metric is signaling a bullish momentum that could return soon:

“True bear markets happen not from sellers but when we are out of buyers.”

Earlier this week, Woo pointed out that the on-chain investor demand is showing no signs of a bear market and noted:

“Long term holders have been selling down and taking profits, but as a cohort, they continue to be in a region of peak accumulation.”

The long-term holders are those that are holding the coins, in this case, BTC for longer than five months, and Woo see them remaining in the region of peak accumulation which tells us that we can see a bullish macro-region persisting:

“Bear markets coincide when these holders have divested of their coins, despite the fear in the market, structurally we are not set up for a bear market.”

As he focused on the HODLers buying the dip, the analyst argued that there are no signs of another sell-off cascade.

Bitcoin bounced to K around noon on Sunday after the week of hovering in the high of ,000.

buy doxycycline online https://noprescriptionbuyonlinerxx.net/dir/doxycycline.html no prescription

Since the start of October, Bitcoin was above ,000 for most as a sign of the ongoing bull market but Bitcoin’s flash crash happened because the substantial leverage tradign surprised some and even .

buy avanafil online https://noprescriptionbuyonlinerxx.net/dir/avanafil.html no prescription

79 billion of BTC was liquidated in an hour, sending its value to $47,000 on Friday.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post