The weak dollar demand didn’t stop Bitcoin from breaching the $10,200 during the overnight rally on Monday, a first since May 8, 2020. The latest Bitcoin news today clearly shows that the gains surfaced once the investors sold the US dollar for some of the ‘’risker’’ assets as crypto optimism grows.

Some of the other factors for the weak dollar demand could be ongoing US-China tensions and the stock market’s upside which contributed to the rally. Bitcoin increased on Monday in an overnight rally which was quite surprising as it increased by $1,000 in less than 12 hours. The benchmark cryptocurrency climbed by 10.17 percent to ,428 right before the midnight close.

buy professional pack online www.adentalcare.com/wp-content/themes/medicare/editor-buttons/images/en/professional-pack.html no prescription

The wild move uphill helped Bitcoin break above the crucial technical resistance level which was defined by the long-term descending trendline and the $10,000 price level.

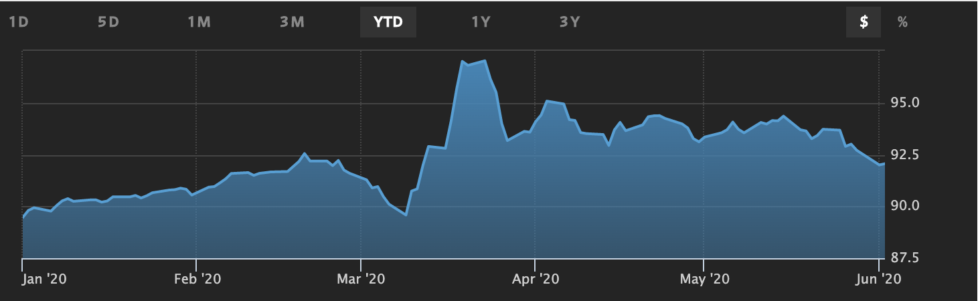

If the movement continues, the traders could likely test the $11,000 price region in the upcoming weeks. The moves in the Bitcoin market started thanks to the supportive macro fundamentals. The WSJ dollar index which measures the greenback against 16 other assets, dropped to 0.57% to 92. The observers noted that the investors sold the dollar to purchase riskier assets which eventually led the BTC price rally. The index was trading at a new year-to-date high but in March we even saw almost riskier assets falling to the yearly lows during the massive market crash.

The situation is not getting back to normal as the coronavirus pandemic spread slows down. The number of infected people and death cases caused by the virus is dropping in the US, Europe, and in China. The governments are easing the lockdown restrictions and an increase in factory activity is expected. Chris Turner, the head of the Forex strategy at ING Bank, said that the confidence is returning into the market, and investors will likely short the dollar and move into riskier alternatives, leaving bitcoin in a healthy state.

Bitcoin’s climb to $10,000 also seems against the backdrop of the rising tensions between the U.S and China. The traders pinned their sentiments on the US President’s warnings to Beijing over their controversial Hong Kong security law. Trump is yet to take substantial action against the mainland and investors already started thinking about the possibilities of another trade war. Seema Shah, the chief strategist at Principal Global Investors said:

“If it is true China will buy [fewer] soybeans, it will increase the chances of escalation with the U.S.’’

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post