One Wall Street Veteran launched his own BTC fund with his initial $25 million investment, showing that the demand for the leading crypto asset is growing. Wall Street is all over BTC in the past few months because of the growth of the need for a hedge. But let’s learn about this new fund today in our Bitcoin latest news.

The wall street veteran launched his own BTC fund with a $25 million investment showing that the demand is growing. Anthony Scaramucci who is the founder of $9.2 billion SkyBridge Capital, launched a BTC fund to enable registered investment advisors to invest in the number one cryptocurrency.

buy clomiphene online http://med.agisafety.com/wp-content/themes/twentyseventeen/new/new/clomiphene.html no prescription

SkyBridge will be operating the fund and it filed a Form D with the Securities and Exchange Commission for the new fund. To boost the fund and show that there’s interest in it, founder Scaramucci put $25 million of his own capital into the fund.

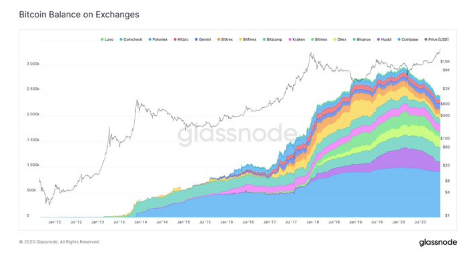

He believes that the fund will allow for a broader number of investors to gain more exposure to the benchmark cryptocurrency. The goal is that many institutional players or retail traders find it hard to invest in this asset. In a sign of continued support for BTC, the number of coins on exchanges was in a steep decline. Referencing the charts, Rafael Schultze Kraft, the CTO of Glassnode stated:

#Bitcoin is in a supply and liquidity crisis. This is extremely bullish! And highly underrated. I believe we will see this significantly reflected in Bitcoin’s price in the upcoming months. Let’s take a look at the data.”

#Bitcoin is in a supply and liquidity crisis.

This is extremely bullish! And highly underrated.

I believe we will see this significantly reflected in Bitcoin's price in the upcoming months.

Let's take a look at the data.

A thread 👇👇👇 pic.twitter.com/vx6rJmiloE

— Rafael Schultze-Kraft (@n3ocortex) December 21, 2020

A huge buyer of the coins is of course, Microstrategy. The American Business services company wrote in a press release that was published earlier this week that it purchased $650,000,000 worth of BTC with the company thinking that BTC will increase more over time and outpace the current levels. The Wall Street BTC accumulation continued despite the asset going on a prolonged consolidation period with the latest one being from Grayscale that continued accumulating. It was noted that the company’s leading BTC trust added 12,319 BTC to its holdings in one day. the number one cryptocurrency continues to be accumulated by Grayscale and as Kevin Rooke noted that the Grayscale Bitcoin Trust added the coins in one single day which is more than the 11,512 that they added during the past week when BTC broke its all-time high.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post