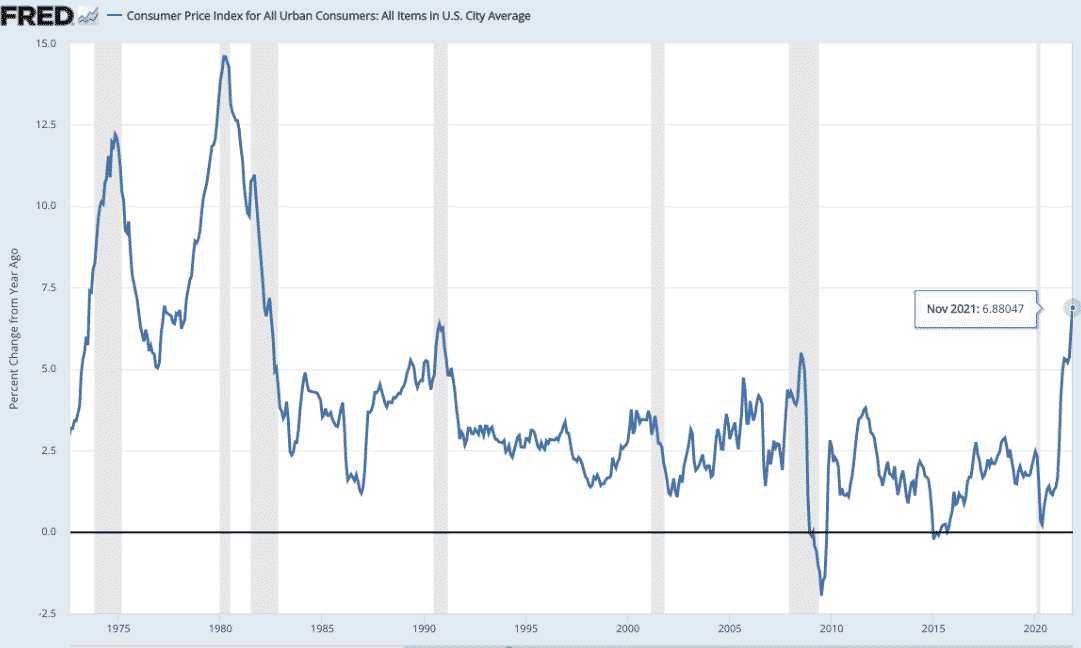

The US inflation reached a 39-year high rate with the consumer price index surging to 6.8% in November. The traders could hold off the investments in risky assets by the rest of the year as Bitcoin immediately reacted to the news so let’s have a closer look at today’s Bitcoin latest news.

Bitcoin’s price shifted from gains to losses after a US Inflation report showed the consumer prices increasing in November which ended up reaching the highest level in 39 years. The market fluctuations left Bitcoin ont the rack for the fourth weekly decline with the forecasts of $100,000 by the end of the year looking impossible. BTC can’t even go back to its high of $69,000. Crypto traders were waiting for the release of the US consumer price index on Friday because most investors saw Bitcoin as a potentially useful tool against inflation.

buy cymbalta online blackmenheal.org/wp-content/themes/twentytwentytwo/inc/patterns/en/cymbalta.html no prescription

The reports show that the index for all items increased by 6.8% in the past year which is the highest level since May 1982 when it was set at 6.9%.

The cost of living increase was also in line with the predictions of economists in the Reuters survey and was higher than Octobers’ 6.2% increase. Bitcoin climbed past $50,000 but then ceded the gains to trade in the red as analysts shifted to the logical conclusion that the US inflation rates are a motivation for the Federal Reserve to decide and speed up its withdrawal of monetary stimulus meeting in a week from now where all US Central Bank’s monetary policy committee will meet. The senior market analyst at Oanda brokerage explained:

“If financial markets grow nervous, the Fed may have an aggressive tightening cycle, and the first thing that gets sold is your top-performing assets and that would be cryptos for many traders.”

By the end of the day, Bitcoin turned up along with the traditional markets with traders noting that the inflation number is not as high as some economists warned. With BTC being down for weeks, crypto markets analysts are starting to discount the likelihood of the end-year rally similar to the 2020 behavior. Coinbase research analyst noted:

“We may not see heavy risk-taking by institutional investors in the last weeks of December for tactical reasons. As a result, cryptocurrencies may be range-bound for the remainder of December in our view.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post