The US dollar boom puts BTC on the verge of crashing once again as many BTC strategists and investors started looking at this year with convictions that the dollar will be the one to crash. So far, however, the predictions are proving false so let’s read some more in our latest Bitcoin news today.

While BTC gained 73 percent against the dollar since the start of January, it extended its uptrend even further especially since the pandemic started back in 2020 and the dollar started trading higher against the basket of foreign currencies, marking an increase of 2.52% this year. BTC supporters expected the dollar to drop given the Federal Reserve’s efforts to keep the interest rates near-zero via its infinite bond-buying policies while traders and analysts predicted that the dollar will suffer even more from the increasing debt levels in the US that could restrict growth. However now, the US dollar boom only shows that economy is growing and enhancing.

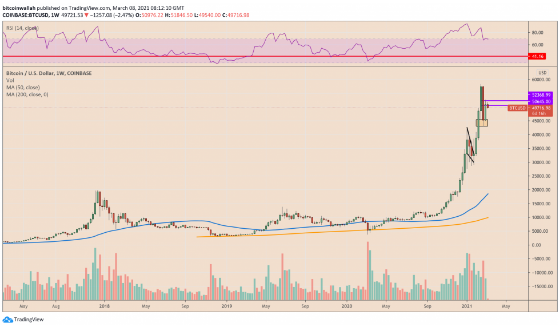

As a result, the sell-off in the government bonds is picking up momentum and sends the yields higher dramatically. This prompted investors to shift the focus from the US dollar’s bearish narrative and concerning the massive liquidity but their focus zoomed in on the US economy’s recovery pace. With the return of US exceptionalism so-called, the crypto market is now feeling a slowdown in growth. The BTC/USD exchange rate reached $58,367 in February which is the highest level on record but the pair corrected since by 12.66% per the latest readings. At its lowest point, BTC was down 26.30 percent from the historical peak and the cryptocurrency risks correcting lower to neutralize the status of overvaluation.

This is the case with US tech stocks usually as they fell into the bear market trap. This includes Tesla whose stock value dropped 33.59 percent from the high of $9000 per share. As the yields rise alongside the US dollar, BTC and the Nasdaq Composite Index formed a positive correlation with one another. The capital is moving into the pandemic losers with the sectors underperforming during the pandemic which is now booming on the reopening of the economy. That further prompts foreign investors from the European Union to put more money into us and to push the dollar upwards.

Many expect BTC to continue heading higher as investors with an anti-inflation outlook are still preferring it against traditional rivals like gold. Mike McGlone, the popular Bloomberg analyst even predicts that the BTC/USD rate will hit $100,000 this year.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post