US Citizens pour all of their stimulus check money right into Bitcoin and gold according to two reports today as we are reading further in our latest Bitcoin news.

The US Citizens seem to be loving bitcoin as the US Bank JPMorgan stated yesterday, saying that younger investors are likely to choose Bitcoin as an investment over gold while many of them are pouring their excess cash into crypto. All reports suggest the same outcome which is that crypto adoption and investments are rising in terms of economic uncertainty.

$2052 (+71%)#bitcoin

— $1200 Stimulus Is Now Worth (@BitcoinStimulus) August 5, 2020

The falling interest rates are tempting some of the Americans to find another safer solution for their money and put their savings into assets such as stocks and Bitcoin. The move came as the traditional stores-of-value such as low-interest bank accounts lost relevance as the risky assets provide huge returns. The report outlined that the standard advice in finance groups on social media is to keep cash in high-yield savings accounts. However, the rates on these have fallen quite a bit for the past year.

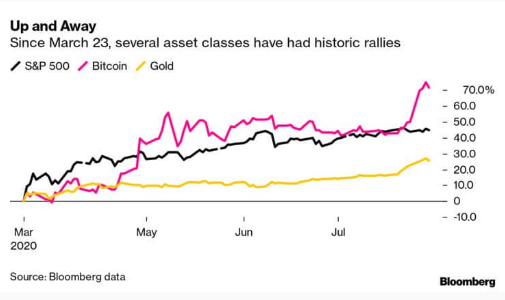

The consumer arm of Goldman Sachs Group Ally and Marcus, gave the investors rates of about 1% while Defi project such as YFI boasted 1000% returns. They both dropped from the last year’s 2% interest rate as the US Federal Reserve cut the rates for the first time since 2008. However, returns from cryptocurrencies are quite bigger. Bitcoin gave returns of 55% this year while Ethereum and Chainlink gave a minimum of 300%. The reports suggest that the upside is yet to be realized as the Americans are quite confident about the market in the long run, but there are some of them who believe that the stock market will crash and crypto is a safe haven.

18% of the respondents chose cash investments such as savings accounts while a smaller percentage chose crypto. JPMorgan Analyst Nikolaos PAnigirtzoglou said that the younger investors are interested in alternative assets such as BTC. The Millenials are embracing stocks and technology shares where others are selling equities. Older generations continue to use bonds as their preferred choice as the data for their strong buying shows clearly. The analyst referred to investment flows for their reports.

Gold and BTC ETFs have seen some strong inflows over the past five months and both the younger and the older generation set the case for an alternative currency according to Nikolaos.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post