The US-China tensions dented again and pose a huge global risk while Bitcoin failed to maintain the $9,000 level after starting off to a bad start this week. The market, however, remained certain about the long-term price rally and the bullish sentiment disregarded the correlation bitcoin has with the S&P 500 so let’s find out more in the following Bitcoin price news.

Bitcoin sold off at $9,000 again as investors are awaiting the start of the new US-China tensions and trade war during the shattering coronavirus pandemic. The number one cryptocurrency dropped 3.09 percent to hit the intraday low at $8,633 during the trading session on Monday which is only a day after it reached $9,203 price region. The drop reflected the inability of the traders to hold a Bitcoin support close to the $9,000 especially right before the mining reward halving.

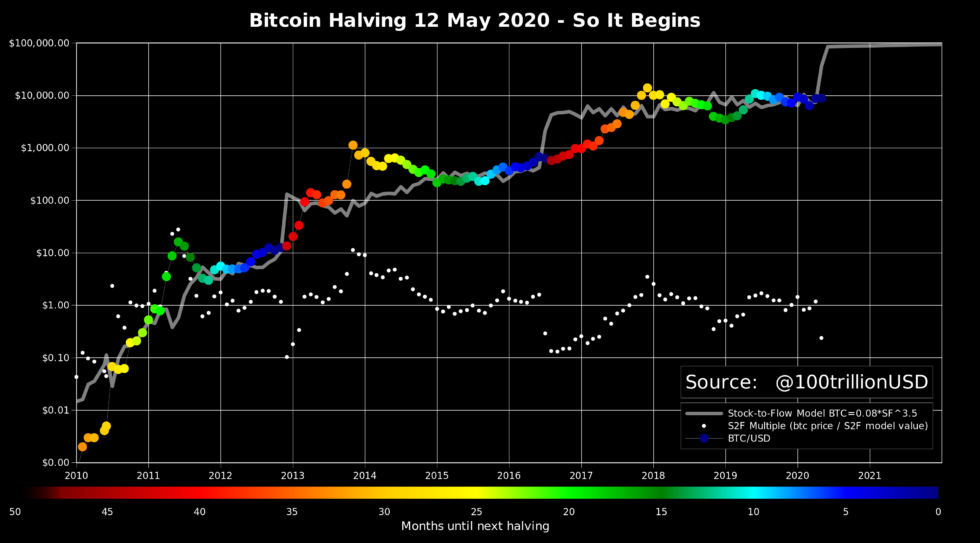

The bitcoin halving event will see that the daily supply level went down from 1,800 BTC to 900 BTC and the traders believe it would make the cryptocurrency more scarce and more valuable. The popular price prediction predicts that the Bitcoin price will reach $100,000 by the end of 2021. The traders are still waiting for their crypto positions for the short-term profits and the downside sentiment came after Mike Pompeo the US Secretary of state commented about the claims of the Chinese government’s role in hiding the severity of the coronavirus.

Mr. Pompeo explained that the Bejing stockpiled medical supplies back in January while still ignoring to share the major potential impact of the virus with the rest of the world:

“We can confirm that the Chinese Communist Party did all that it could to make sure that the world didn’t learn in a timely fashion about what was taking place.’’

Mr. Pompeo’s statement hinted that the tensions between the U.S and China are on the rise again as it was seen in the exchange rate in early Monday trading. The RMB dropped 0.3 percent to 7.1561 per US dollar which is the lowest region in the past 45 days. The ING’s chief China economist Robert Carnell explained that the drop could serve as a major signal to another US-China tensions and trade war:

“It is possible that the US administration feels emboldened to restart the trade rhetoric given the rally stocks have undergone in recent weeks.’’

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post