The crypto news today show that FTX debuts a product that delivers quarterly settlements which are based on the Bitcoin hash rate. In other words, trading Bitcoin hash rate futures is now possible and the option calculates using the average difficulty.

Bitcoin (BTC) holders now have this new tool to work with, leveraging the largest coin and its growing ecosystem as the two new futures markets go live. In a blog post on May 15th, the derivatives platform FTX shared this and confirmed that it had launched a futures product which enables trading Bitcoin hash rate futures.

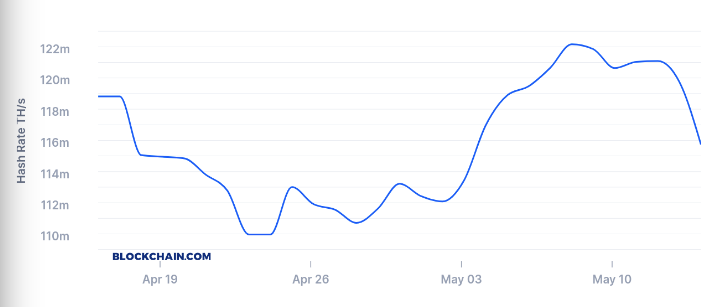

Simply dubbed “hash rate futures,” these contracts basically track the average difficulty of the BTC network each day from the beginning until the end of each quarter. As we can see from the Bitcoin news now, the difficulty is used – and not the hash rate – because as FTX noted, measuring the hash rate accurately is impossible.

“However, given that difficulty adjustments attempt to maintain 10m block times, over long periods of time the average hash rate will be proportional to the average difficulty,” the blog post explains. “So, that means that, roughly speaking, difficulty futures should behave similarly to hash rate futures.”

For those of you who don’t know, hash rate refers to the computing power that is dedicated to the Bitcoin network at any given time. The more hashing power there is, the more secure and strong the BTC network is.

Trading Bitcoin hash rate futures is good news now, especially with the mining difficulty and all the other updates post the BTC halving this month. As you probably know from our Bitcoin news, the mining difficulty and hash rate have been hovering near all-time highs, but the hash rate tailed off following the BTC block subsidy halving this week.

At press time, the FTX hash rate product was outperforming the Q1 2021 contracts which are climbing from a value of around 16 to 21.5 on the day. Contracts which will expire in Q3 and Q4 of 2020 rose by 6% and 13%, respectively.

With all of this, the FTX exchange joins the crypto exchange Bitfinex in expanding the futures market. Last week, the latter released futures related to Bitcoin’s dominance versus the other altcoins.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post