The trading activity in BTC futures listed on the Chicago Mercantile Exchange (CME) dropped to a 3-month low as we are reading more in the upcoming BTC news.

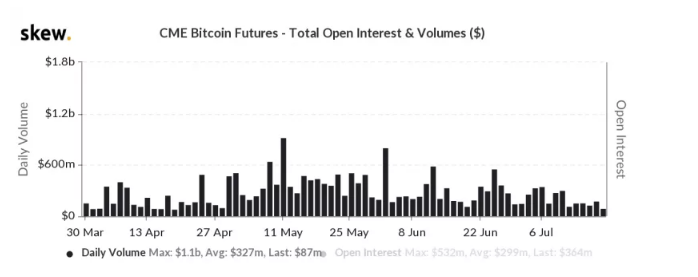

The daily trading activity in BTC dropped to $87 million and hit the lowest level since April 17 when the exchange-traded contracts were worth $77 million according to the data from derivatives research platform Skew. The volume topped out at $914 million on May 11 as Bitcoin underwent its third miner reward halving and was in a declining trend ever since. The halving was expected to put a strong bid under the cryptocurrency but Bitcoin started an uptrend from the March lows below $4000 and stalled following the halving as the cryptocurrency had remained locked in a range of $9000 to $10,000 ever since.

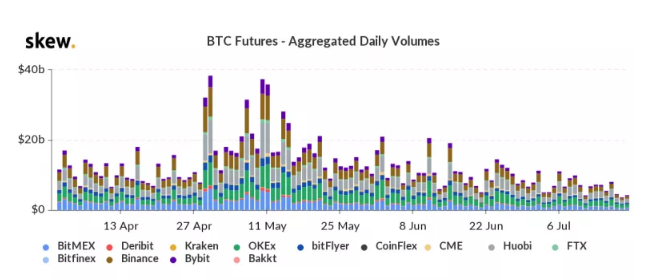

The quiet period for BTC trading seems to be the primary reason behind the decline in CME’s futures volume as the global daily volume by adding numbers from BitMEX, OKEx, Kraken, Deribit, BitFlyer, CoinFLEX, CME and Bitfinex also dropped over the past two months. The aggregate daily volume as of Sunday was set at $4.65 billion which is down by 87% from the $36 billion seen in May. Matthew Dibb, co-founder of Stack explained:

“Continued range-trading and an inability to confidently break above $10,000 has led investors to allocate capital into other segments of the crypto market.”

Other alternative cryptocurrencies such as the oracle network LINK, Stellar’s XLM, and other tokens associated with the Decentralized Finance space such as Compound’s LEND received much more attention from the investor community over the past week or two. Tokens such as LINK and XLM witnessed a surge in trading volume on the spot market this month while Bitcoin’s volume in both the spot market and futures market dropped.

LINK’s trading volume on Coinbase increased by 67% while XLM’s volume jumped by more than 40% to new record highs. In the meantime, bitcoin trading dropped for the third month in a row. Dibb said:

“With the hype around the DeFi, this trend may continue for the short-term.”

The open positions in futures listed on the CME also dropped along with the daily trading volume as $364 million worth of positions were open on the CME, or down by 31% from the previous high of $532 million.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post