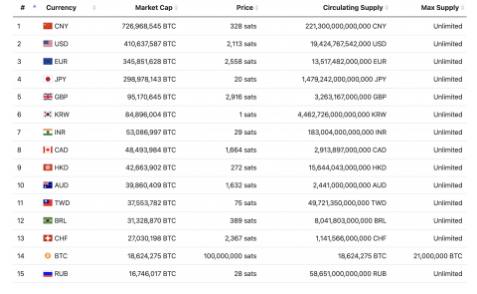

The Russian Ruble is now officially behind Bitcoin as the leading cryptocurrency continues absorbing all of the capital along the way causing the price of the market cap to surge. The recent uptrend and the price increase in BTC caused the asset to surpass the Russian Ruble in terms of total market cap as we are reading more in today’s Bitcoin news.

The cryptocurrency continues rising on the global currency list by rank and this is extremely important for the future of the cryptocurrency. The Bitcoin naysayers are in the first line of defense and they will point out that actually very few use the asset as a currency. The first cryptocurrency was designed as a peer-to-peer form of “digital cash” but today the cryptocurrency functions as digital gold instead. Rather than using BTC for paying for services, the investors hold it for the long-term rather than spending it.

The holders that decide to spend it, at last, end up regretting it later when the price appreciates a lot. There’s not that can prevent BTC and other assets from being spent anywhere where they are accepted and while this could be limited, more merchants that accept crypto are showing up. Regardless of its current use, Bitcoin is still a currency. While the crypto space is a long way off from catching up to the gold market cap, it sure does have some superpowers especially as we can see that the Russian ruble is now behind it.

The Russian Ruble is officially overtaken by Bitcoin and the cryptocurrency proves to be more valuable than all of the supply of Russian-made money which exists globally. The proximity to the top ten currencies by global rank and the fact that BTC is crawling behind the Swiss Franc is a big deal. The franc is a global reserve currency which makes it notable if BTC surpasses it. The argument that BTC is not a currency doesn’t hold any weight but it could be a sign that it is on its way to becoming the most dominant global reserve currency.

Bitcoin will then have to face the Brazilian real and the Taiwan dollar and next up are the yen, yuan, and the US dollar. What’s interesting about BTC is that a few are using it as currency today so if the volatility does dissipate in the next few years of adoption, there’s no reason why the users of the technology will turn to day-to-day transactions instead.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post