A few technical signals suggested that Gold is preparing to revenge against Bitcoin as the economy weakens and more fiat money is printed. This led to BTC reaching incredible heights but considering the history of the cryptocurrency of major drawdowns, things could turn at any moment so let’s read more in our latest Bitcoin news today.

The technical signals suggested that BTC could be in big trouble against gold which reached a TD 9 sell setup on monthly timeframes. The signal if confirmed will suggest the current trend is exhausted and bounce is coming sooner than it was initially expected. Gold’s reputation was slowed down for a while in its long history as a safe haven asset and a store of value. According to the entrepreneurs like Mark Cuban and other analysts, the metals were being demonetized by the likes of crypto.

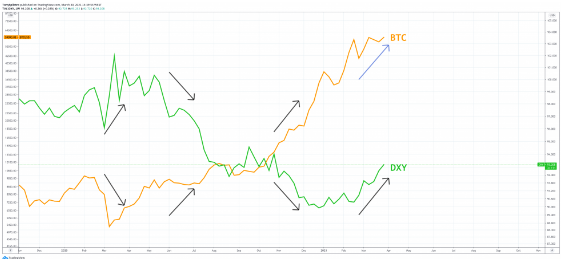

The digital gold narrative in 2020 is what caused the gold bull market to top out and the BTC to surge. Since then, the leading cryptocurrency by market cap amassed a $1 trillion market cap and got a chunk of the gold’s cap that’s ten times the size. If the cryptocurrency is able to absorb that much capital, it will trade at a price of $500,000 per coin or more. While BTC is rapidly approaching trillions of dollars in capital, the divergence between the assets grew dramatically and a reversal signal appeared. The TD sequential indicator issued a TD 9 sell setup which suggested that the steep downtrend of the candles will reverse. Coinciding with the fall, starting in October 2020, gold dropped by 84% compared to BTC’s price.

No one can say for sure and not even the TD Sequential indicator despite being accurate most of the time. The signal fails usually and when it does, the resulting move is stronger. Markets tend to reverse when sentiment reaches extremes and the sentiment in metals is on the other side of the spectrum. Gold was bumped off the list of Morning Brew market tickers for BTC but is this a sign that a peak is nearing?

As previously reported, One of the oldest institutions in the United States Bank of New York Mellon or shortly, BNY Mellon values BTC compared to gold and claimed that the cryptocurrency became a widely accepted asset, choosing to get ahead in innovation. Now, BNY Mellon published a valuation on BTC comparing the gold characteristics to the cryptocurrency while trying to determine its value.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post