A fresh surge in trading activity has sent Bitcoin’s market cap above the one of Warren Buffett’s Berkshire Hathaway with the $30,000 price point reaching as mainstream interest starts pouring in. In our latest bitcoin news today, we take a closer look at the reports.

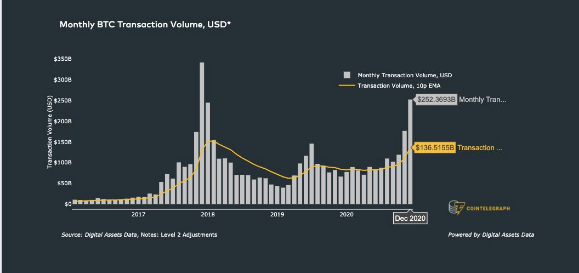

BTC has posted the highest transaction volume since 2018 as the data pointed out since more investors are entering the market. the figures from the on-chain analytics platform Digital Assets Data outlined that this month is sparking Bitcoin’s second-biggest transaction volumes. Other indicators like the size of the unprocessed transactions in the mempool and network transaction fees show that there was an increase in activity overall.

Wallets that contain large and small balances continued increasing as well to levels never seen before. Google Trends also captured the highest level of search interest for BTC since February 2018. The fresh surge in trading activity could like boost Bitcoin above the $30,000 price range soon enough. One reason for that is the price bull run which is still unstoppable this week. At press time, BTC was trading close to the $29,000 range amid the stubborn refusal to consolidate lower. The biggest cryptocurrency surpassed the market cap of Berkshire Hathaway of $539 billion while its CEO Warren Buffett linked BTC to “rat poison squared” on one occasion.

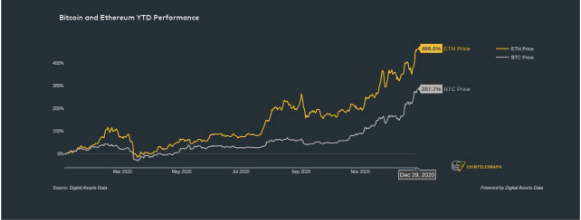

Despite its 290% year-to-date returns, BTC still pales compared to the performance of the biggest altcoin Ether. The ETH/USD pair sealed more gains of 500% since the beginning of January. Bobby Ong, the creator of the price data site Coingecko predicted that ETH will see a return to higher transaction fees but it will also surpass its existing all-time high from 2018:

“ETH will break past its $1,500 ATH mainly driven by DeFi. Gas fees will skyrocket again and highlight scalability issues.

buy Tretinoin generic https://onlineandnewblo.com over the counter

Most of the year will be spent coordinating on a Layer 2 scalability solution. My bet will be on ZK Rollup gaining traction towards the end of the year.”

Ong predicted a price trajectory towards $100,000 alongside the launch of the exchange-traded fund and the first central bank that added BTC to its balance sheet.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post