Stocks and Bitcoin fall together hand in hand as the Russia-Ukraine tensions are enhancing and scaring the markets so let’s take a closer look at today’s latest Bitcoin news.

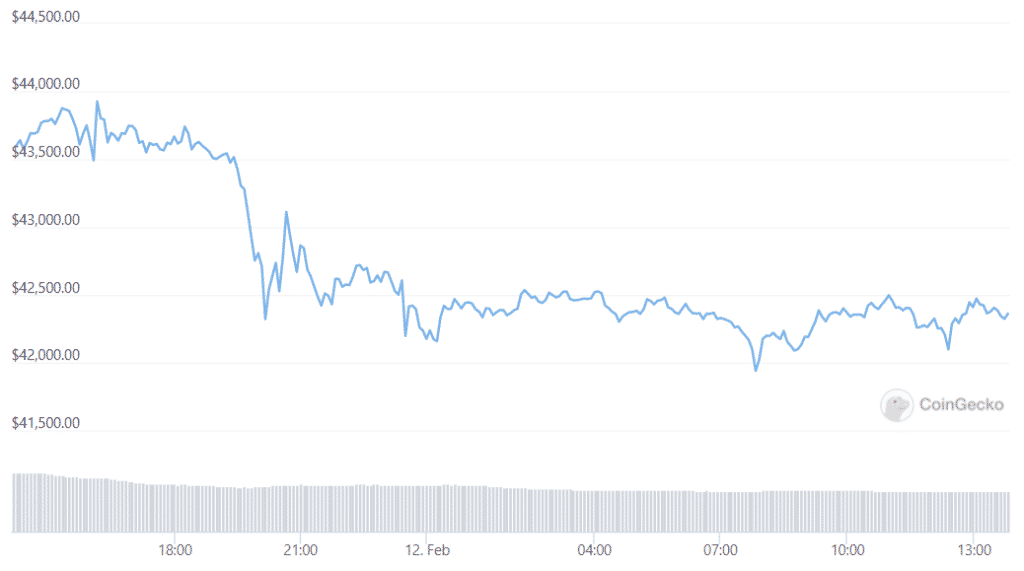

Solana, Ethereum, and the rest of the coins are leading the tumble in price and the crypto markets dropped on Friday alongside the US stocks as investors dumped even riskier assets amid the fears that Russia can soon invade Ukraine. Bitcoin as the largest crypto by market cap was down by 4% in the past day and according to coin market cap, it was trading for $42,496 at the time of writing.

The altcoin market took the biggest hit. Solana as the eighth biggest cryptos by market cap was down by 10% and XRP as the sixth one was down by 8.29% to $0.7751. Ethereum as the second biggest crypto also crashed by 5.6% in the past day and it is now trading at $2,932. As stocks and Bitcoin both falter, what are the bigger reasons for the crash?

The increased tensions between Ukraine and Russia have a heavy influence over the market prices and the talks of war-making headlines every day only contribute to the factor. The Russian troops are amassing the Ukrainian border and today the White House said that Russia could invade the country in the next few days but the fears of inflation also played a huge part in spooking the investors with the US inflation hitting its highest level in 40 years.

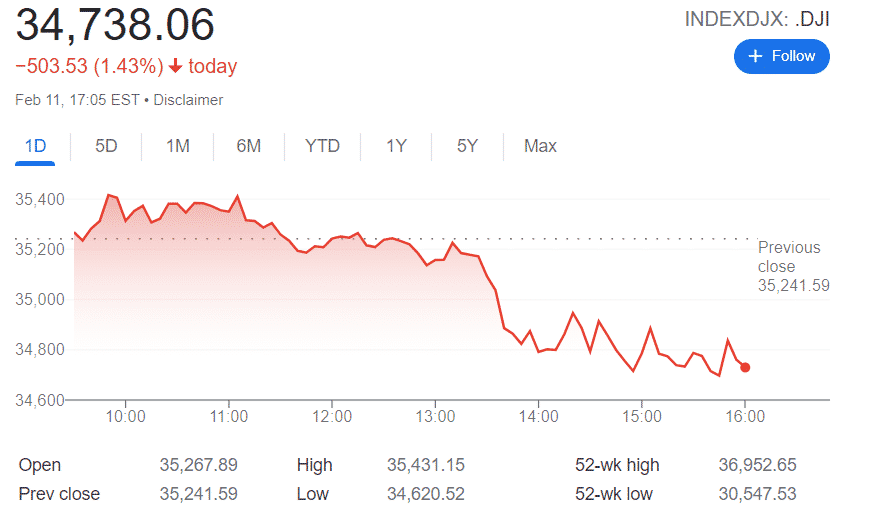

At the time of writing, the Dow Jones Industrial Average was down by 1.4% to 501 points to 34,740 and the S&P 500 SPX dropped by 90 points or by 2%.

As recently reported, After tapping a new high of $46,000, Bitcoin rejects at $46K again and pushed south almost instantly. Other coins are deeper in the red and there were some substantial losses from Solana, Polkadot, Ripple, SHIB, and others but THETA is among the exceptions that made double-digit surges. Bitcoin spiked to $45,000 over the weekend for the first time since January after reclaiming $40,000 but the bears didn’t allow for further increases and they pushed the coin south to below $43,000. After a few days of stagnant movements, BTC tapped $45,000 again yesterday before embracing its volatile nature in the next few hours. After the US released its highest inflation rate numbers in 40 years of about 7.5% BTC dropped by $2000.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post