The stock prices of BTC mining companies crashed during the recent market downturn with the rest of the cryptocurrencies also being in freefall so let’s read more today in our latest Bitcoin news.

The stock prices of BTC mining companies continued to drop after the recent BTC price crash with Riot Blockchain being the biggest loser. In a tweet by Arcane Research’s Jaran Mellerud, the data showed that five of the biggest mining stocks by market cap took a dip with year-to-date losses of up to 50%. Marathon Digital Holdings is down YTD 62% with Hut8 only slightly higher at 63% and according to Arcane Research data, Riot suffered the biggest loss at 65%.

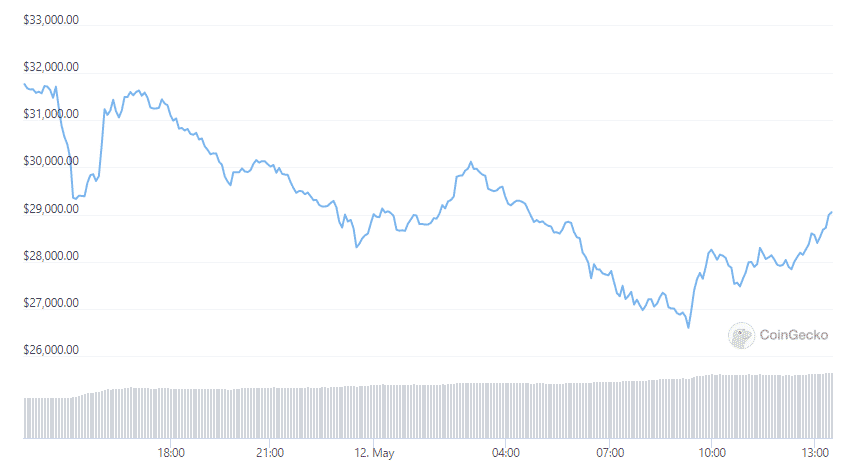

As a part of the reason for the losses, most crypto companies hold BTC which means that they are affected by the BTC Value. The biggest crypto by market cap lost about 605 of its value since its ATH in November 2021. right now, BTC is struggling at $26,000 and dumped by $14,000 in the past week. In the meantime, the BTC crash led to less revenue for mining companies and Mellerud noted that a drop in the BTC price can also cause a decrease in the global hash rate the situation is quite different in 2022 and the hash rate charted a new high as well.

buy filitra online https://www.arborvita.com/wp-content/themes/twentytwentytwo/inc/patterns/new/filitra.html no prescription

According to the analyst, the BTC price crash and the increase in global hash rate caused companies to mine less BTC:

“Most of these companies have not grown their hashrate as fast as investors were hoping. Investors may have adjusted their growth assumptions for these companies to more conservative territories.”

In the meantime, the Canadian crypto miner Hive Blockchain announced more plans to consolidate the common shares five to one. According to the press release, the move will reduce the number of common shares issued from 411,209,923 to 82,241,984 while increasing the company’s share price. The stock consolidation is expected to attract a lot of institutional investment and the statement from Hive’s executive chairman Frank Holmes said:

“Even though HIVE has a higher market capitalization than many of our peers, and stronger fundamentals as measured by Price/Earnings ratios, revenue per employee and debt to equity ratios, the increased share price creates more institutional visibility because many of their fundamental screens exclude stocks under $5 a share.”

The common shares after consolidation are expected to start trading on both the TSX exchange and the NASDAQ by May 202 after they get regulatory approval. Hive also entered a supply agreement with Intel to purchase new ASIC mining chips.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post