The Retail accumulation rises as the number of small BTC addresses containing 0.1+ and 1+ BTC hit a new high as we can see in today’s latest bitcoin news.

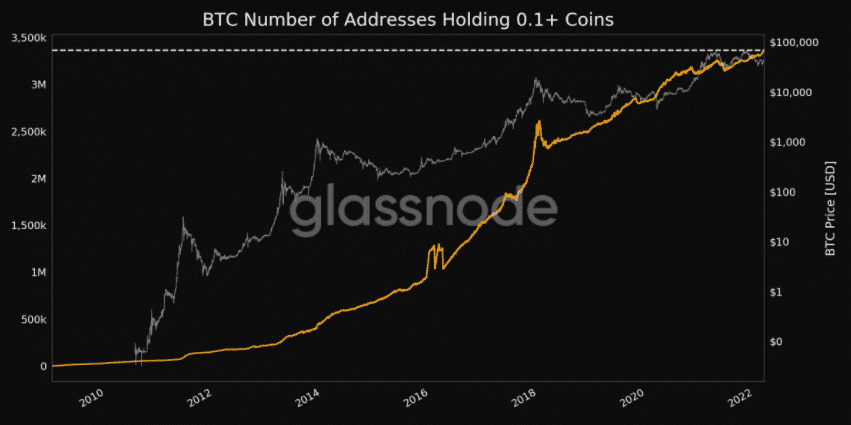

The retail accumulation rises and is returning on the Bitcoin landscape according to the number of small bitcoin addresses. Those that hold at least 0.1 BTC marked a new high while the wholecoiners are at a 10-month peak. The data from Glassnode shows the gradual growth of BTC wallets containing 0.1 or more BTC and it also shows that these entities surged during the 2017 bull run when the retail mania was on the rise and crashed in the following months as the asset started cooling off and retraced by 80%.

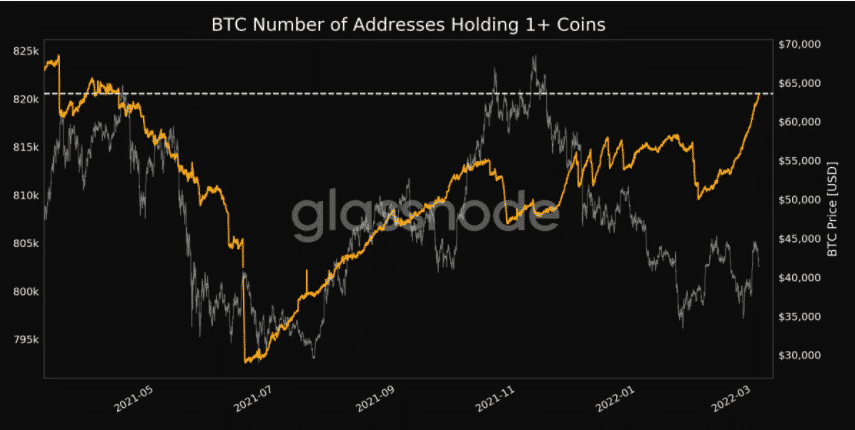

Even though BTC trades are higher than in 2017, the retail demand has been quite gradual than spiking and there are about 3,400,000 of these accounts which is a new high. The Wholecoiners which represent addresses holding at least one BTC also increased and in that case, this increase has been quite aggressive. Such entities reached a 10-month high with the data from Glassnode showing that more than 820,000 addresses holding on BTC or more.

The google trends data shows that the number of BTC queries on the world’s biggest search engine increased as well which is another indicator that suggests a rise in retail interest. The reports also show that the growing demand is not coming from retail investors alone but also from whales. The wallets containing 1000 BTC or more, surged to a 10-month high of their own. The addresses with 100 coins increased to a new monthly high and in both cases, what was most intriguing seemed to be the fast increase that came a few days after Russia launched an attack on Ukraine and the western countries imposed financial sanctions against Russia which led to many people speculating that the oligarchs and other Russians turned to crypto that was supported by the surge in tradign volumes that are coming from the world’s biggest country by territory.

As recently reported, The adverse price developments on the market are still ongoing as BTC Dumped below $40K and most other altcoins are in the red with Terra losing 7% and BNB dropping below $380. The current war between Russia and Ukraine harmed the financial markets worldwide but BTC managed to recover the losses quite fast when the West refused to get involved directly in the war.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post