Ray Dalio now owns BTC as the legendary investor and founder of Bridgewater Associates, just as Max Keiser, the BTC proponent predicted half a year ago as we read here in our Bitcoin news.

After the inflationary concerns and monetary policy stances that the US government announced, Dalio grew a fan of BTC as a store of value and it is starting to hold it at a higher level compared to certain traditional vehicles like government bonds. After a long period of suppressed demand, the economy bounced back from the pandemic and brought along with it, problems of supply shortages across the board. The sustained price increases are now reaching the market as the US sees the biggest inflation jump since 2008. it’s a time for investors that have large cash reserves or treasury bonds to see their nominal purchasing power drop rapidly.

Ray Dalio like most in the crypto space thinks that BTC will fare better than bonds in this inflationary era like the one we are in right now. The narrative that BTC is a hedge against inflation still hasn’t been proven in practice but the economic theory is solid. Provided the sustained level of demand, a reduction in supply will lead to a price increase. A point of contention is the legitimacy of the BTC demand or how much of it is actually mania fuelled compared to the one gotten from manipulation. This depends on how much fundamental utility BTC can retain once the market settles.

However, Ray Dalio now owns BTC and said that Bitcoin’s greatest risk is its success. As BTC gains more popularity as a valid alternative as a store of value from the eyes of the government and will start to be seen as a legitimate threat to authority. This is happening now as regulations creep in but a potential death blow could happen if the government bans crypto altogether. Michael Burry predicted that a Weimar-like spike I in inflation will hit the US and took a short position in treasury bonds, saying that it could be time for BTC to prove its worth.

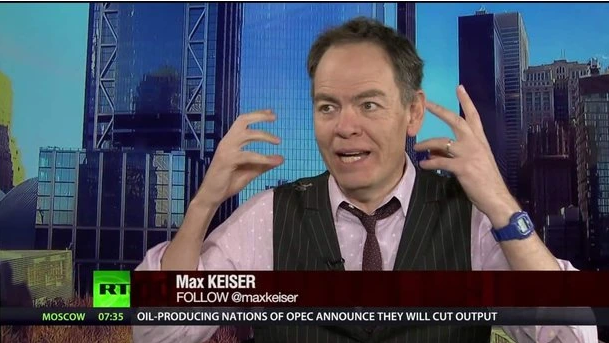

Max Kaiser who is the host of the Keiser Report, said that Dalio’s move will cause the rest of the industry to “fall in line” and suspects that international funds in Qatar and Norway will make bigger positions in BTC soon.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post